Japan’s government debt crisis is certainly pushing bond yields higher. We don't expect that it will cause a Lehman-like global financial crisis. Nevertheless, Japan's Bond Vigilantes are sending a clear message to governments worldwide about the need for fiscal discipline, observes Ed Yardeni, editor of Yardeni QuickTakes.

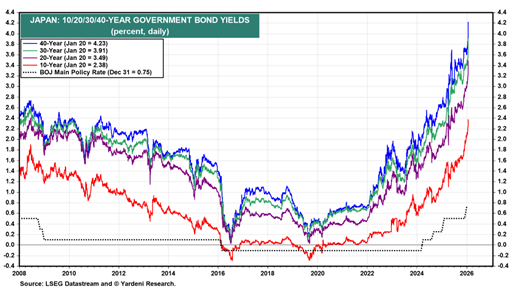

The problem in Japan is that the Bank of Japan has been trying to normalize monetary policy by raising its main policy rate since early 2024. However, inflation remains stuck around 3%, well above the BOJ's 2% inflation target and the current policy rate of 0.75%.

The BOJ is tightening too little, too late, because the economy is weak, prompting the new government to push for fiscal stimulus. That will widen Japan's government deficit, adding to the record public debt. The Bond Vigilantes are protesting by driving bond yields higher.

Rising Japanese yields seem to have put upward pressure on yields in other developed countries, which also have excessively high government debt-to-nominal-GDP ratios. The US bond yield has been rising as the odds of further Federal Reserve rate cuts have decreased, too.

In addition, the Bond Vigilantes may anticipate that the Supreme Court will rule that Trump's tariffs are unconstitutional, thus reducing government receipts from customs duties. Furthermore, on Jan. 7, President Trump posted on Truth Social that he would ask Congress to raise the 2027 defense budget from the already approved $901 billion to $1.5 trillion, calling it the Dream Military and citing troubled and dangerous times.

Despite the above, we still expect the 10-year US Treasury bond yield to trade between 4.25% and 4.75% for most of this year. We expect US inflation to fall to 2% and that the Treasury will issue more bills if necessary to avert higher bond yields.