Global markets opened the year with a tone of cautious confidence. Equity indices, however, tell only part of the story. Major benchmarks have been largely flat, masking a pronounced internal rotation, notes Michael Gayed, editor of The Lead-Lag Report.

In the US, economic momentum remains firm enough to keep the Federal Reserve on hold at its January meeting, with consensus expecting no policy change. Growth has proven resilient, inflation has moderated but remains above target, and policymakers appear comfortable maintaining restrictive settings while they assess how disinflation evolves.

Volatility remains subdued, suggesting investors are broadly comfortable with the macro backdrop despite political noise and ongoing debates about central bank independence. The message from US markets is not one of exuberance, but of stability paired with a growing willingness to reposition risk.

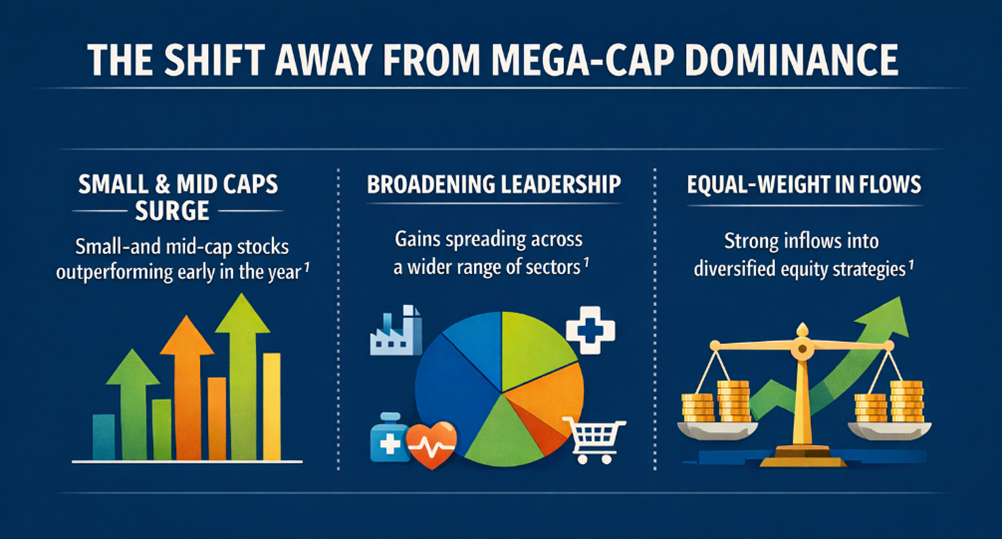

That repositioning has been most visible in the shift away from mega-cap dominance. After several years in which a narrow group of large technology companies accounted for an outsized share of returns, leadership has begun to broaden.

Small- and mid-capitalization stocks have surged early in the year, recapturing investor attention after prolonged underperformance. Equal-weight equity strategies have also attracted strong inflows, reflecting a desire for diversification away from heavily concentrated benchmarks.

For investors and traders, the message is one of balance. Broadening participation and emerging leadership offer opportunities, but discipline remains essential. Rotations can fade as quickly as they appear, and periods of calm often precede renewed volatility.

As the year progresses, close attention to policy signals, earnings trends, and leading indicators will be crucial in determining whether this early-year resilience evolves into a more durable advance – or proves to be another head-fake in an uncertain global cycle.