Markets sold off late last week, with technology names under the most pressure. Bitcoin, metals, emerging markets, and international markets also took a hit. Let this volatility settle out for a couple of days, then review allocations and investments and adjust accordingly if needed, suggests Lance Roberts, editor of the Bull Bear Report.

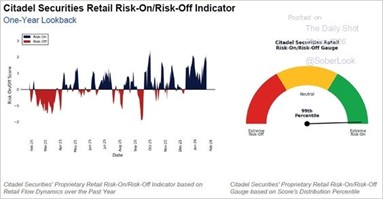

It wasn’t too surprising given that investors were very long equities going into earnings season. As shown here, Citadel Securities (which pays for Robinhood’s order flow) just published its retail investor risk-on/off sentiment indicator. At 99%, it was the most “risk-on” since last October.

Furthermore, the eight-month rate of change in margin debt is now at one of the highest readings in history. Such current readings have occurred only about five times previously, and all preceded more significant market corrections. Note: This is a monthly indicator that lags, so these readings can remain very high for quite some time.

While last week’s selloff was fairly brutal, the market backdrop remains intact. The market is wrestling with the S&P 500 Index (^SPX) 7,000 resistance level, but that level also coincides with the long-term bullish trend where markets have struggled previously.

Money flows also remain strong, at least for now, suggesting that any pullback to near- or intermediate-term support will likely be bought. The negative divergence in relative strength is a concern. But the markets can ignore technical warnings for some time, particularly when they are very speculative.

While a more severe correction remains a low-probability event, the current correction should not be a surprise either, as leverage and speculation have gone “too far, too fast.” For now, while it may “feel like we must do something,” it’s most likely the best option to “do nothing.”