Having a process is critical to finding leading stocks. At MoneyFlows, we understand that supply and demand is the ultimate power law. Our work has identified Micron Technology Inc. (MU) as one of the best AI stocks for 2026, notes Lucas Downey, co-founder of MoneyFlows.

Datacenter, storage, and memory chip names have been the darlings of Wall Street for months. We believe these trends are potentially the trade of 2026.

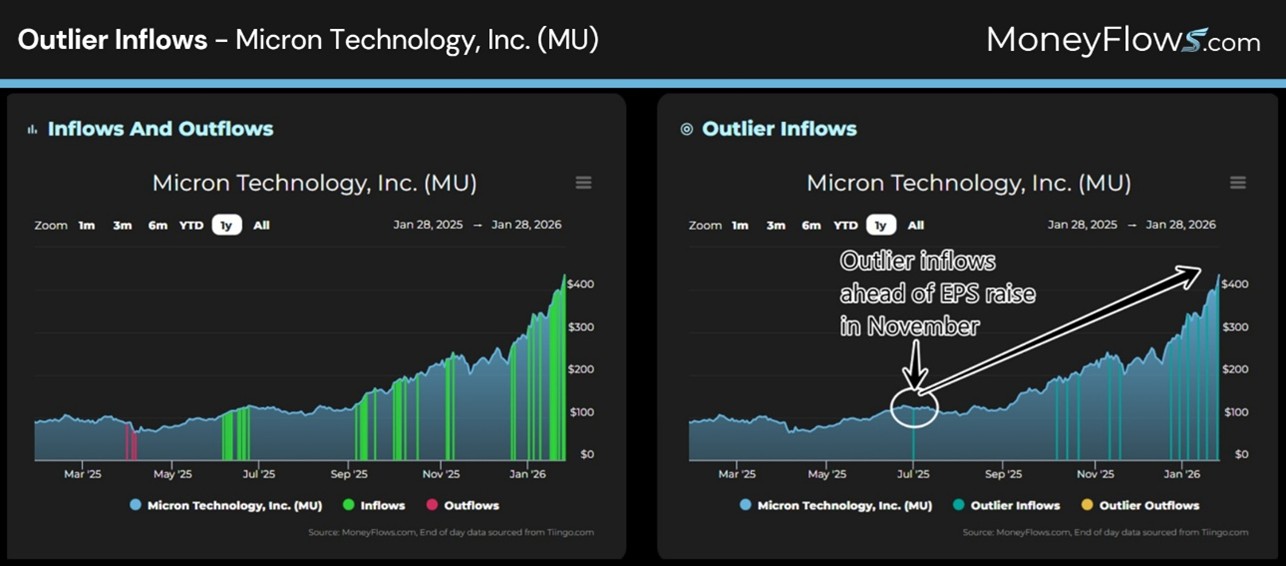

Meanwhile, every single day, stocks are bought and sold, revealing institutional footprints. This information is powerful to uncover the best stocks in the market…early. Back in October, I showcased our top technology stocks. Storage and memory chip names were under heavy accumulation. That trend has only accelerated.

Micron is a storage and memory manufacturer. The $500 billion market cap company has benefited immensely from the memory bottleneck that’s expected to last through 2028.

What turbocharged this stock recently was the surprise Q2 guidance that occurred on Dec. 17. The company raised their quarterly earnings per share target to $8.42 at the mid-point, shattering analyst estimates of $4.78. For FY2026, estimated EPS have climbed from $7.26 in January 2024 to a whopping $32.91 as of January 2026.

But if you think institutions were caught off-guard – think again. MU shares have been under extreme accumulation since July. The stock has been regularly profiled in our Outlier 20 report since MU shares traded at $120. At last measure, the stock had reached $418 per share.

Let’s say it again: Earnings follow stocks!