Was last week the wildest week in the metals market…ever? It sure looked and felt that way! But what does it mean longer-term if you’re a metals trader or investor?

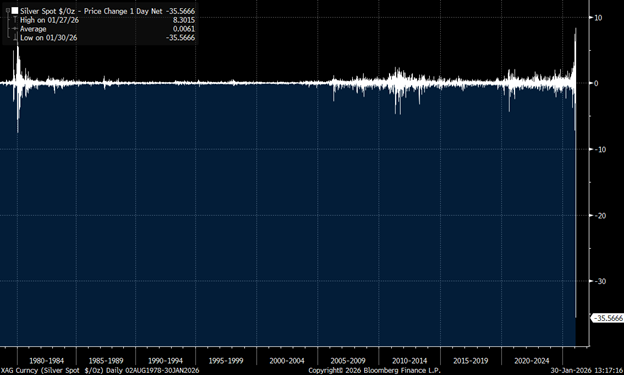

Let’s start with a double-dose of MoneyShow Charts of the Day. The first shows the net 1-day price change in spot silver since the late 1970s.

As you can see, the dollar amount that silver covered last week was unlike anything we’ve ever seen. The junior precious metal plunged from a high of $121.60 on Thursday, Jan. 29 to as low as $74 on Friday, Jan. 30. Wow!

Silver Just Swung the Most in History

Source: Bloomberg

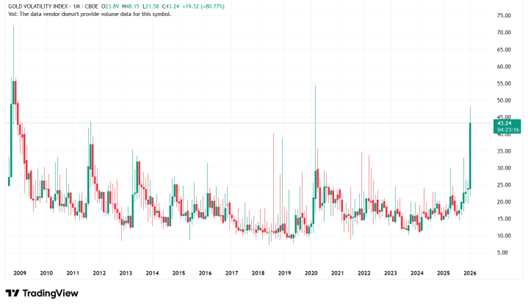

Next, take a look at my second chart – the CBOE Gold Volatility Index (^GVZ). It shows expected 30-day volatility of returns on the SPDR Gold Shares (GLD). Or in other words, it’s like the “VIX”...only for gold rather than stocks.

Gold Volatility Soared - But Not QUITE to a Record

Source: TradingView

In this case, the GVZ soared to as high as 48.1 last week from 23.9 the week before. That’s a huge move. But that reading wasn’t quite as high as the 71.9 peak we saw during the Great Financial Crisis or the 54.3 level we saw during the Covid pandemic.

But let’s not split hairs. Wild it was. It put a big exclamation point on these statements I shared last Monday: “We’re going almost parabolic in the short term, which increases the risk of a painful correction out of the blue. Traders should keep that in mind.”

Now here’s the important part: Throughout this bull market in bullion, we’ve had periodic blow off peaks. I wrote about the last one in October here. But none of them proved to be the proverbial “Top” for the whole bull run. They were just waystations on the road to higher prices.

As a TRADER, you can’t get caught up in the momentum when things go parabolic. You have to tighten stops, reduce position sizes, and take other precautionary steps to protect yourself.

As an INVESTOR, you have to remember to take advantage of sharp pullbacks. Let the volatility settle down, wait for metals to find new bases, then start adding on the cheap. One day that approach will stop working – when the final top is in.

But for what it’s worth, I don’t think last week was it!