If you look at a typical emerging markets ETF, such as the iShares MSCI Emerging Markets ETF (EEM), you will usually find one country dominating the portfolio: China. That backdrop has driven the rise of emerging markets ex-China ETFs. The largest example is the iShares MSCI Emerging Markets ex China ETF (EMXC), says Tony Dong, lead ETF analyst at ETF Central.

In EEM, China currently accounts for about 26.5% of assets. That concentration is largely a byproduct of market-cap weighting. Once US, European, and Japanese mega-cap companies are excluded from the global opportunity set, large Chinese firms make up a significant share of what remains.

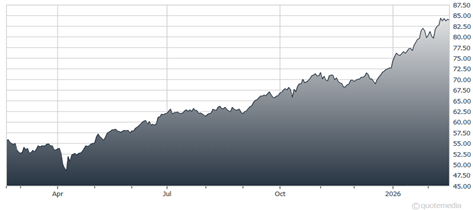

iShares MSCI Emerging Markets ex China ETF (EMXC)

The issue is not just concentration, but the type of risk it introduces. The relationship between the US and China has become increasingly strained, shaped by trade disputes, technology restrictions, national security concerns, and broader competition for global influence.

Over the years, there have also been periodic concerns around the potential delisting of Chinese American Depositary Receipts (ADRs) from US exchanges. While those scenarios have not fully materialized, they have been enough to make some investors uncomfortable with heavy China exposure embedded inside a broad emerging markets allocation.

EMXC takes the standard emerging markets universe and simply removes China, leaving exposure to countries such as India, Taiwan, South Korea, Brazil, and others. It holds about $15.8 billion in assets under management.

Size, however, does not automatically imply best-in-class construction or lowest cost. While EMXC dominates the category by assets, it is not the only option. Three other NYSE-listed emerging markets ex-China ETFs that are worth watching are the Columbia EM Core ex-China ETF (XCEM), Vanguard Emerging Markets Ex-China ETF (VEXC), and Dimensional Emerging Markets ex China Core Equity ETF (DEXC).