Should you “Go Global” in your portfolio? I think so. But more than that, the data shows it’s paying off!

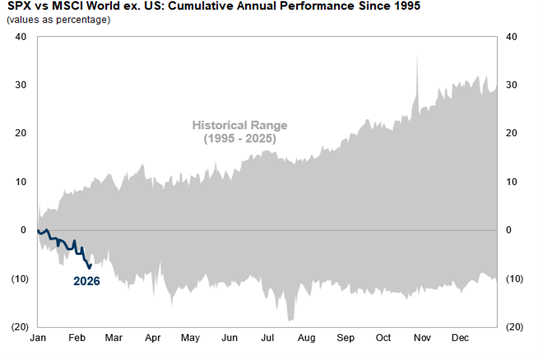

Check out my MoneyShow Chart of the Day. It shows the performance of the S&P 500 Index (^SPX) relative to the MSCI World ex. US Index. You can see that so far in 2026, US stocks are underperforming global equities by the widest margin in 31 years!

Source: Goldman Sachs

The year is still young, of course. But this isn’t a new trend. US stocks radically underperformed global stocks last year, too. The State Street SPDR S&P 500 ETF (SPY) has delivered a total return of 18.4% since Jan. 1, 2025, compared with 44.8% for the iShares MSCI ACWI ex US ETF (ACWX).

Why? My guests on this week’s MoneyShow MoneyMasters Podcast covered some of the reasons here. But in a nutshell, it stems from currency market movements, geopolitical developments, economic stimulus, and valuations.

The US dollar is falling. The Trump Administration’s policies are helping shift global alliances and capital flows. Foreign economic stimulus is boosting growth prospects in Asia and Europe. And foreign equities are cheaper than US stocks. The forward P/E for the S&P is around 22X, compared with only 15X for the MSCI ex-US index.

Those are all reasons why investing beyond US borders looks like a smart play here. It’s worth noting that this isn’t a new suggestion for me. I’ve been saying the same thing for more than a year at MoneyShow events. And I plan to keep sharing that message until market dynamics shift!