About Sam

Sam's Articles

Sam's Videos

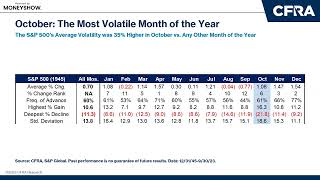

During the first quarter of 2024, the S&P 500 (1) recovered all that it lost in the 2022 bear market on January 19, (2) recorded 22 new all-time highs through March 28, and (3) posted the 11th strongest Q1 return since 1945. Since then, equities have digested some of these gains and experienced sector rotation away from the 2023 high flyers and into the more defensive areas of the market on concerns the Fed will be slower to lower interest rates while inflation remains sticky and GDP growth begins to cool. Investors now want to know if they should buy or bail. Sam Stovall, the chief investment strategist at CFRA Research, will discuss how current conditions may confirm or alter the traditional election-year enthusiasm, as well as share CFRA’s sector, sub-industry, and stock selections in what historically has been a surprisingly profitable year.