The first quarter 2024 earnings reporting period is about to get underway. The S&P 500’s Q1 2024 operating earnings per share (EPS) are expected to have risen 3% on a year-over-year (Y/Y) basis, according to S&P Capital IQ consensus estimates, notes Sam Stovall, chief investment strategist at CFRA Research.

Macro-level factors that are expected to have contributed to underlying growth include a projected 3% Y/Y increase in Q1 2024 real GDP, a 1.9% gain in retail sales, a sub-2% rise in West Texas Intermediate (WTI) oil prices, and a jump in the 10-year bond yield from 3.48% in Q1 2023 to 4.20% for Q1 2024.

For Q1, the S&P MidCap 400 and SmallCap 600 Indices should post EPS declines of 4.4% and 12.6%, respectively. Six of 11 sectors are forecast to record Y/Y increases, led by double-digit growth for the communication services, consumer discretionary, and information technology sectors. The deepest declines are expected to come from the energy, health care, and materials groups.

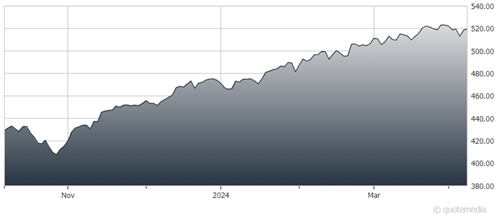

S&P 500 ETF Trust (SPY)

From a sub-industry perspective, 52% of the 145 groups with Y/Y EPS comparisons are projected to report increases, led by broadline retail; forest products; and hotel, resorts & cruise lines. The deepest Y/Y declines in EPS are forecast to come from companies in the aluminum, health care technology, and passenger ground transportation groups.

For all of 2024, estimates point to an S&P 500 EPS increase of 9%, followed by a 13.7% gain in 2025. Similarly, the S&P MidCap 400’s EPS are seen rising 4.9% and then 16.5%, respectively, while the S&P SmallCap 600’s should jump 12.8% and then surge 17.7%. Finally, as of April 4, the S&P 500’s P/E on a forward-12-month EPS stands at 21.6x, a 32% premium to its average since 2005.

Representative companies from the list of S&P 1500 sub-industries with the highest EPS growth are: Louisiana-Pacific Corp. (LPX), Amazon.com Inc. (AMZN), Airbnb Inc. (ABNB), Arch Capital Group Ltd. (ACGL), NVIDIA Corp. (NVDA), Live Nation Entertainment Inc. (LYV), Alexandria Real Estate Equities Inc. (ARE), and American Tower Corp. (AMT).