ECONOMY, GLOBAL, STOCKS

John Divine

Senior Financial Markets Editor,

U.S. News & World Report

- Senior Investing Reporter for U.S. News & World Report

- Previously with Motley Food and InvestorPlace

- Frequent Contributor to Numerous Financial Media Outlets

Follow

About John

John Divine is a senior investing reporter for U.S. News & World Report, where he's been covering the stock market, Wall Street, and the economy since 2016. Prior to U.S. News, he covered the stock market professionally for The Motley Fool and InvestorPlace. Since turning to journalism, Mr. Divine has appeared on numerous financial media programs—discussing Wall Street earnings, acquisitions, valuation, and other issues—including Cheddar, Money Life With Chuck Jaffe, iHeartRadio, WSJ Radio and WBBM Chicago, as well as several other outlets.

John's Articles

A time-tested financial stock, PayPal Holdings (PYPL) is curiously trading for less than its 2020 pandemic lows, despite earnings per share of $4.13 in 2022 – higher than any year between 2018 and 2020. Shares were absolutely hammered in 2022, shedding 62% due to a weaker macro environment and the loss of its lucrative relationship with eBay (EBAY), notes John Divine, editor of US News & World Report.

The year 2022 was a lousy one for the stock market. But so far in 2023, market performance has been MUCH better. One company worth looking at for the second half of the year is Dutch Bros (BROS), notes John Divine, editor of US News & World Report.

The investment landscape has changed dramatically in the last year or so, and the unprecedented era of near-zero interest rates is over. Stocks with generous dividends can offer relative stability combined with healthy yields in this environment, with OneMain Holdings (OMF) a good example, writes John Divine, senior financial markets editor at US News & World Report.

Dutch Bros (BROS) is, simply put, a coffee chain. But don't be fooled by its deceptively basic business — it is also a rapidly expanding growth stock with a current valuation of around $5 billion, suggests John Divine, senior financial markets editor at US News & World Report.

John's Videos

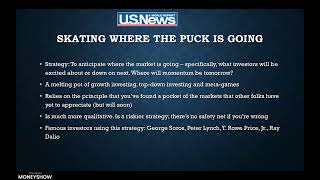

The value vs. growth debate is an old one, and successful investors have amassed fortunes using both strategies. This presentation will outline some timeless principles that both value and growth investors use, and, using these principles, give specific examples of market opportunities that exist today.