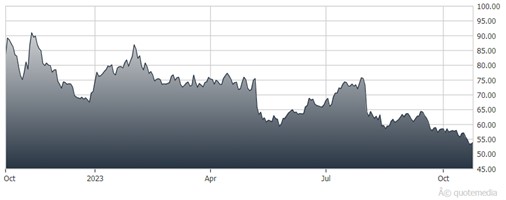

A time-tested financial stock, PayPal Holdings (PYPL) is curiously trading for less than its 2020 pandemic lows, despite earnings per share of $4.13 in 2022 – higher than any year between 2018 and 2020. Shares were absolutely hammered in 2022, shedding 62% due to a weaker macro environment and the loss of its lucrative relationship with eBay (EBAY), notes John Divine, editor of US News & World Report.

Shares now trade for less than 12 times expected 2023 earnings, despite a five-year average ratio of 35.5. Between 2015 and 2021, PayPal's lowest price-to-earnings (P/E) ratio was 20.3.

Applying that conservative multiple to its average expected 2023 earnings of $4.93 yields a price of $100.08 per share by early 2024, implying significant upside from its recent level of $57.

PayPal Holdings (PYPL)

Recently announced deals with Apple Pay to accept PayPal- and Venmo-branded cards should expand its presence in brick-and-mortar retail. Amazon (AMZN) also now accepts Venmo (which is owned by PayPal), giving PayPal exposure to Amazon's vast online marketplace.

PYPL shares tumbled in May after the company reported less-than-stellar earnings and then again on Aug. 3 after second-quarter earnings showed a loss in active accounts and a large drop in free cash flow. The stock was recently down 20% in 2023.

A turnaround could be possible following the company's announcement it would be tapping Intuit (INTU) small business exec Alex Chriss to be CEO. Chriss took the helm on Sept. 27.

Recommended Action: Buy PYPL.