The investment landscape has changed dramatically in the last year or so, and the unprecedented era of near-zero interest rates is over. Stocks with generous dividends can offer relative stability combined with healthy yields in this environment, with OneMain Holdings (OMF) a good example, writes John Divine, senior financial markets editor at US News & World Report.

Between March 2022 and March 2023, the Federal Reserve raised the federal funds rate from a target range of zero to 0.25% to a range of 4.5% to 4.75%.

With inflation high and the risk-free 10-year U.S. Treasury bond now paying about 3.5%, investors are demanding more income from their stock holdings. There are plenty of dividend stocks to choose from, but far fewer boasting yields that compete with Treasurys.

Unlike government bonds, equities offer both dividend income and the potential for capital gains. Not all dividend-paying stocks have made big gains in this year’s turbulent market, but they can be attractive in this environment.

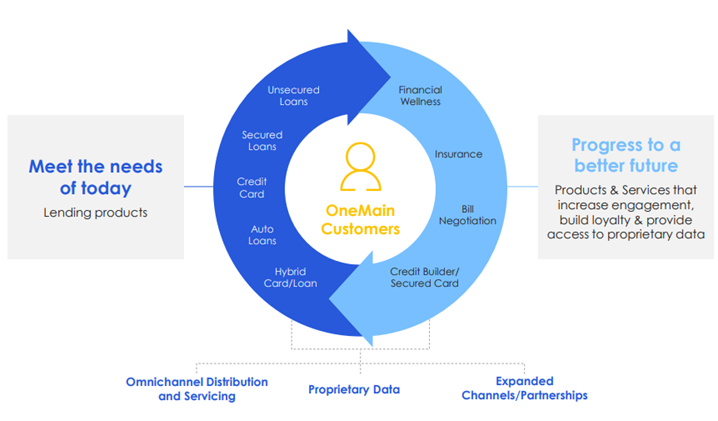

While perhaps a bit off the beaten path, OneMain Holdings is a $5 billion mid-cap financial company based out of Evansville, Indiana. Now going strong for 111 years, OneMain underwrites personal loans and insurance, with a strong presence in auto loans, credit cards and life insurance.

Rising rates are often good for businesses like OMF, which enjoys higher margins as a result. The stock looks cheap at about six times earnings, and its dividend rewards investors with a great income stream for holding the stock. Including dividends, OMF stock was recently up about 3% year to date.

Recommended Action: Buy OMF.