About Martin

Martin's Articles

Martin's Videos

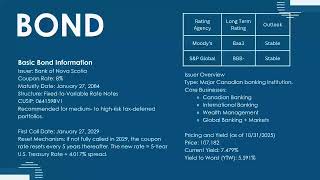

Opposing economic forces currently pose major challenges for income investors. The Fed appears to be on a course of continuing to cut interest rates, but tariffs still threaten to inflame inflation, which could force an abrupt change of course. Credit risk premiums are extremely low by historical standards, but yields are up considerably from their lows of recent years. This session will present a path forward through diversification by income asset class, while also highlighting specific securities that offer attractive risk-reward tradeoffs at present.

Upcoming Appearances

Martin's Books

How to be a Billionaire: Proven Strategies from the Titans of Wealth

It Was a Very Good Year: Extraordinary Moments in Stock Market History

Investment Illusions: A Savvy Wall Street Pro Explores Popular Misconceptions About the Markets

Newsletter Contributions

Income Securities Investor

Forbest investment newsletter providing advice on bonds, preferred stocks, convertibles, and other income securities.

Learn More