A common stock we recommended last month, CMS Energy (CMS), had an impressive history beyond what we included in our write-up. It all goes back to the concept of “Yield on Cost,” shares Marty Fridson, editor of Forbes/Fridson Income Securities.

Had you bought the stock at the end of 2014, your yield—based on a $1.08 annualized dividend and a then-prevailing price of $34.75—would have been 3.11%.

But each year after that, CMS increased its dividend, paying an annualized $1.95 by the end of 2023. You would have been collecting a handsome yield of $1.95 ÷ $34.75 = 5.61% on the dollars you originally invested in the stock. That far exceeds the 1.50% yield on the S&P 500 on December 31, 2023.

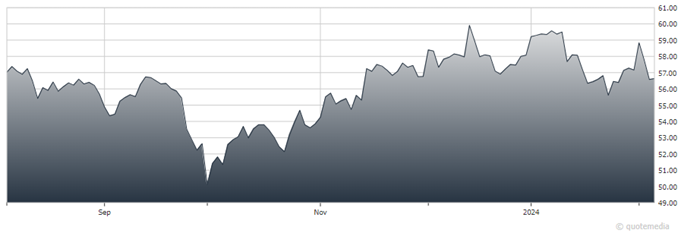

CMS Energy (CMS)

Of course, if you select common stocks for high current income, you’re generally making a tradeoff against potential price appreciation. Utilities like CMS aren’t high-growth vehicles, offering instead the comfort of a dependable revenue source.

Yet between the end of 2014 and the end of 2023, CMS’s share price climbed from $34.75 to $58.07, a 67.1% gain. While collecting an attractive yield, you’d have enjoyed a respectable 5.87% compound annual growth rate on your principal.

Yield on Cost—defined as today’s annualized dividend divided by the price that you originally paid for the stock—is a key reason for including common stocks in an income-focused portfolio. If you instead owned only fixed-rate bonds or preferreds, then over time you’d lose considerable purchasing power to inflation. Stocks of companies that steadily increase their dividends over the years can help you offset that effect.

CMS is a great example, but by no means unique. A diversified portfolio of well-selected dividend growth stocks can serve an investor who’s interested in earning high current income, combating the ravages of inflation, and preserving and increasing principal over time.

Recommended Action: Buy CMS.