About Phil

Phil's Articles

Phil's Videos

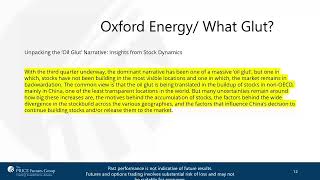

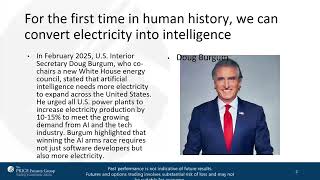

As we approach the new year, shifting supply-demand dynamics and increasing market volatility could be setting the stage for one of the most transformative periods in the history of the energy sector. While weather is a key factor, geopolitics take center stage; global diesel supplies are short, and demand expectations for artificial intelligence continue to rise. Early weather forecasts for winter 2025 suggest colder weather and increased snowfall in the northern US. These conditions could drive up demand for heating fuels at a time when supply chains are already under pressure. Meanwhile, US natural gas exports are rising, adding further strain to domestic availability.

How is OPEC viewing the market? Has US oil production hit a peak? Will we be able to power the artificial intelligence revolution without massive new investments—investments that may create significant winners and losers in the energy space? In this session, Phil Flynn will go through several key scenarios and highlight strategies to help you navigate and capitalize on what may be the most exciting time to be involved in the energy space!

Phil Flynn will discuss how to drive the economy of the future with artificial intelligence and data centers, and why under-investment in traditional commodities has set the stage for an explosive new era. Let's explore what's happening and how we can capitalize on this historic opportunity.

How the Trump Administration is going to transform the global economy.