Articles on Forex & Crypto

CONSUMER DISCRETIONARY

CONSUMER DISCRETIONARY

CRYPTOCURRENCIES

CONSUMER DISCRETIONARY

Experts on Forex & Crypto

Virtual Learning

In his recent talks at Moneyshow, Ryan looked for a major top in Bitcoin at $125K. So far, that call was prescient. In this talk, Ryan will discuss how to safely accumulate Bitcoin while it is cheap, before its next big run.

BITCOIN

The cryptocurrency market has officially entered its next chapter: mainstream adoption. In this session, Tony Edward, founder of Thinking Crypto Podcast, breaks down the incredible transformation of crypto from a speculative niche asset to a pillar of global finance. Over the past two years, we’ve seen landmark approvals of Bitcoin and Ethereum ETFs, TradFi giants like BlackRock and Fidelity tokenize trillions in assets, and governments worldwide implement clear regulatory frameworks for digital assets.

Tony will explore how institutional adoption is legitimizing crypto, why the growth of tokenized U.S. Treasuries and stablecoins is fueling dollar dominance, and how blockchain technology is quietly reshaping banking, payments, and capital markets. Attendees will gain a high-level understanding of how the maturing crypto industry offers both opportunities and risks, why regulatory clarity is accelerating innovation, and how these shifts will impact metals and traditional assets. If you want to understand where crypto fits into the future of global finance—and how investors can position themselves as blockchain technology rewrites the rules—this session is for you.

CRYPTOCURRENCIES

Since 2021, Ryan has been looking for a major bear market in Bitcoin to form at $125K. Bitcoin topped at $124,500. Ryan will discuss what he is looking for next.

CRYPTOCURRENCIES

The crypto market is bursting with opportunity — but it’s also littered with landmines. In this eye-opening session, veteran trader and educator Merlin Rothfeld pulls back the curtain on the darker side of digital assets. You’ll discover how to spot the warning signs of scam projects before they implode, avoid getting caught in “too good to be true” rug pulls, and navigate the fast-shifting regulatory landscape without getting blindsided. From shady tokenomics to social-media hype cycles, Merlin will show you how the pros separate real innovation from market manipulation.

Whether you’re a cautious newcomer or an active investor, this session will arm you with a simple, battle-tested checklist to protect your capital — and your confidence — as you explore the world of crypto. Don’t miss this session — one wrong click can cost you everything.

CRYPTOCURRENCIES

Ryan has been a great guide throughout the crypto bull market that started in late 2022. Now he is tracking the final bullish opportunity in Bitcoin before he expects it to enter a protracted bear market.

BITCOIN

Join Robert A. Green, CPA, of GreenTraderTax for a fast-paced 30-minute update on crypto tax treatment following the GENIUS Act, the pending CLARITY Bill, and the IRS rollout of Form 1099-DA. Learn what’s changed—and what hasn’t. Despite new legislation and regulatory frameworks, the IRS continues to treat most digital assets as “property,” not securities or commodities. Robert will break down: Key takeaways from the GENIUS Act and CLARITY Bill, how the new Form 1099-DA impacts tax compliance starting in 2025, why crypto still isn't subject to wash sale or 475 MTM rules, when Bitcoin futures qualify for Section 1256 treatment, and the benefits of Trader Tax Status (TTS) for active crypto traders. This session is ideal for crypto investors, active traders, accountants, and tax professionals seeking to stay ahead of 2025 compliance requirements.

CRYPTOCURRENCIES

Crypto assets experienced a strong Q2, with Bitcoin rising 31% and Ethereum performing even better. But Bitwise believes the stage is set for an even stronger second half of the year. In this presentation, Senior Investment Strategist Juan Leon will examine the key developments from Q2 2025 and explore why they've laid the groundwork for an extraordinary year-end rally.

CRYPTOCURRENCIES

Join Andrew Baehr, CFA, for an overview of the digital asset markets, factors driving institutional adoption, and understanding the broader narrative beyond bitcoin.

CRYPTOCURRENCIES

Explore how DeFi is transforming traditional financial services by offering new opportunities to earn yield and access credit using digital assets. This session will break down core DeFi concepts, strategies, and risks for both beginners and seasoned cryptocurrency users.

CRYPTOCURRENCIES

Face-to-Face Conferences

Conferences

Foreign exchange or forex is the most liquid sector to trade, and while it offers some of the greatest trends and opportunities to profit, understanding their technical tendencies and the geopolitical drivers that moves these markets is essential to trading success. In this section of MoneyShow.com, our team of professional crypto and forex traders will provide you with the tools to navigate these international markets and share their time-tested crypto and forex trading strategies. Discover what creates trends in the currency market and how to handicap these trends like a pro. More importantly, you can also learn how to time those trends for minimum risk and maximum reward using some simple, but effective technical-analysis techniques.

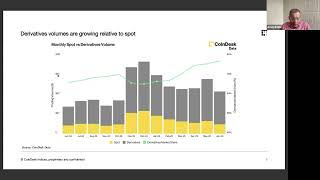

Bitcoin and its crypto cousins such as Etherium, Coinbase, and others have been in the news non-stop in recent years. Speculators and newbies have also been flocking to cryptocurrencies in droves, lured by their wild intraday price swings and eye-popping gains. Two of the world’s largest derivatives exchanges—the CME and the CBOE—have even launched new bitcoin futures, and trading volume in this new product has been steadily rising.

To understand the crypto landscape—the philosophy of crypto and what’s driving the revolution—you need to also understand the economics of cryptocurrencies, the tax implications, and the risks and rewards of trading cryptocurrencies, before you even begin your path to crypto trading.

Whether you’re a newcomer to crypto trading or a veteran trader, you should keep in mind that cryptocurrency trading couldn’t be more different from stock trading. There are various crypto trading strategies that spell out when to buy and sell and how to keep your crypto portfolio safe. It is also critical that you find out how Bitcoin and other cryptos move in relation to forex and how they fit into the risk-on/risk off trade.