Stocks are popping a bit after losing ground yesterday. Gold and silver are mixed, crude oil is higher, and the dollar and Treasuries are trading slightly lower.

Just ahead of the start of the professional football season, Walt Disney Co. (DIS) is going all-in on the sport. It’s swapping a 10% equity stake in ESPN for the National Football League’s NFL Network, NFL RedZone, and NFL Fantasy assets. ESPN is launching a sports-focused streaming service Aug. 21, and this deal increases the attractiveness of that product.

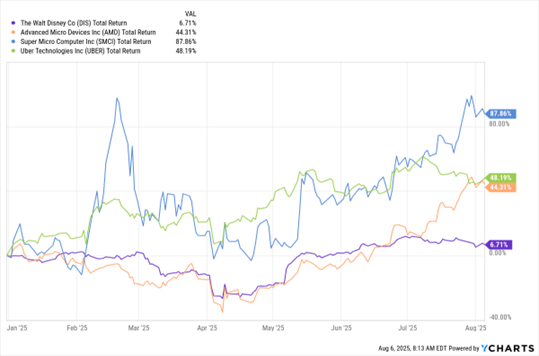

DIS shares dipped, however, after the media, theme park, and cruise company reported lackluster television network and sports programming revenue. Profit in conventional TV entertainment tanked 28% even as theme park income rose 13%. Films like Elio and Thunderbolts* at its Pixar division also disappointed at the box office.

DIS, AMD, SMCI, UBER (YTD % Change)

Data by YCharts

A couple of benchmark tech names are sliding after disappointing earnings. Advanced Micro Devices Inc. (AMD) missed second-quarter earnings estimates slightly due in part to a Trump Administration ban on chip sales to China that has since been reversed. Super Micro Computer Inc. (SMCI) whiffed on estimates, too, thanks to execution flubs and higher costs in its Artificial Intelligence (AI) server business.

On the other hand, Uber Technologies Inc. (UBER) reported stronger-than-expected EBITDA of $2.12 billion in the second quarter and announced a $20 billion stock buyback. Cross-selling between its rideshare and Eats units was solid, while subscriptions for the paid Uber One membership program surged 60% year-over-year. The company also forecast gross bookings of $48.2 billion to $49.7 billion for the September quarter, beating analyst forecasts of $47.6 billion.