Crude oil and stocks continue to vacillate amid uncertainty about what comes next in the Middle East. Oil prices were recently up about 2%, while equities were off modestly. Gold and silver were mixed, while Treasuries were rallying. The dollar was flat.

What will happen next in the Israel-Iran conflict? Investors are trying to figure it out after President Trump left the G-7 meeting in Canada early, then said he was trying to find a “real end” to the conflict versus a simple cease-fire. Meanwhile, Israel has continued to strike Iranian targets – even as reports emerged that the Iranian regime was looking for a way out of a conflict it appears to be losing.

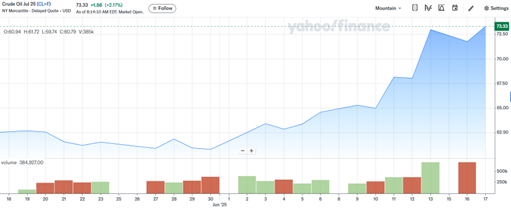

Crude Oil Futures (1-Month Chart)

WTI oil futures were recently trading around $73, while Brent futures were changing hands around $75. The US benchmark is well above its low from last month of $57-and-change…but still several dollars under its high for 2025. That was around $80, set back in January.

No one (myself included) expects the Federal Reserve to cut interest rates at the meeting that concludes tomorrow. Now, Fed “whisperer” Nick Timiraos at the Wall Street Journal has weighed in with an article suggesting the Fed might wait to cut even longer afterward. Officials are reportedly concerned that higher inflation expectations driven by tariff policy will lead to higher inflation itself as businesses raise prices and consumers ask for higher wages to compensate.

That means a cut could be off the table at the Fed’s July meeting, too. But if employment data keeps fraying around the edges as it has been, the Fed’s hand could be forced by September. Markets were recently pricing in a 59% chance of a 25-basis point cut at that month’s gathering.

Finally, shareholders at Verve Therapeutics Inc. (VERV) are waking up to a nice payday. Eli Lilly & Co. (LLY) said it would buy the startup for $1.3 billion to expand a push into experimental gene-editing treatments. The $10.50 offer price represented a 67% premium to where VERV shares closed on Monday.