Bernie Schaeffer has provided stock and options trading ideas, education, and market commentary since 1981; here, the editor of Schaeffer's Investment Research analyzes the historical performance of market sectors between Memorial Day and Labor days, offering insights into the top ETFs for seasonal traders.

Volatility seems to have returned to the stock market just in time for the warmer months, thanks in part to the seemingly perpetual uncertainty surrounding major fundamental drivers like U.S.-China trade, Brexit, and the Fed's future policy path.

But, using summer seasonality as our starting point, we may have uncovered a sector that's set to surprise to the upside in the months ahead.

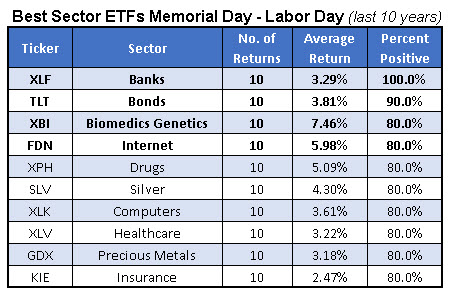

In a study by Schaeffer's Senior Quantitative Analyst Rocky White ran the numbers to determine which sector-based equity exchange-traded funds (ETFs) tend to fare the best over the stretch of time from Memorial Day up until Labor Day. The results — sorted by the percentage of positive returns, and then by average return -- are displayed in the table below.

The SPDR S&P Biotech ETF (XBI) boasts the biggest average summertime return over the last decade, up 7.46% with 80% positive returns.

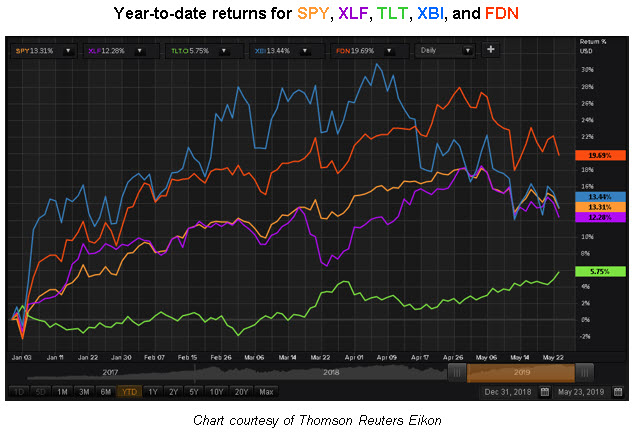

The biotech tracker is down about 11% on a year-over-year basis, but as recently as early April, XBI's 30% year-to-date advance roughly doubled that of the broader SPDR S&P 500 ETF Trust (SPY). Since then, XBI has pulled back quite a bit, and is now matching SPY with an approximately 13% gain for 2019.

But what's troubling about XBI's chart is the fact that it's trading below its bearishly crossed 50-day and 200-day moving averages, with the latter trendline acting as resistance since mid-April.

Short interest on the fund is at its highest level since October 2015, which could potentially contribute to a high-velocity rally -- but until those formidable moving average hurdles are taken out, it's hard to consider XBI as a bullish summer play.

The FANG-following First Trust Dow Jones Internet Index Fund (FDN) typically gains just shy of 6% between the two summer holidays, with 80% of returns positive. And FDN enters Memorial Day weekend as a leader, having tacked on upwards of 19% over the last six months and on a year-to-date basis.

However, that round 20% year-to-date return level could become a sticking point, and FDN is lately threatening to punch below support at its 80-day moving average. That, coupled with the fact that FDN shares sagged about 5% over the past month as investors plowed net inflows of $140.03 million into the fund, keeps the ETF from piquing our contrarian interest.

The "safe haven" iShares 20+ Year Treasury Bond ETF (TLT) boasts 90% positive returns from Memorial Day to Labor Day over the past decade, though its average return of 3.81% for the period doesn't quite compare with those of XBI and FDN. That modest bullish move aligns with TLT's usual tendency toward "slow and steady" share price moves, as seen on the accompanying chart.

Currently, TLT is trading near an annual high, and hovering right around an 11% year-over-year gain. Given this ETF's pattern of outperforming in "risk-off" scenarios when equities are struggling, traders who anticipate a prolonged period of high volatility for stocks may want to consider betting on a repeat of TLT's bullish summer seasonality in 2019.

That said, perhaps the most compelling pick here is the one that's managed a flawless summer track record over the past 10 years, with 100% positive returns in the late May-early September window.

The Financial Select Sector SPDR Fund (XLF) ends the period up 3.29%, on average -- the smallest of the group we've discussed here -- but there are a few factors that could contribute to a bigger-than-usual bounce for bank stocks this time around.

Technically speaking, XLF is testing its footing above support at its 200-day moving average, which previously served as resistance during rally attempts in February, March, and early April. And since the start of April, the big bank fund has held its footing above the level corresponding with a 10% year-to-date gain.

Massive put activity on XLF suggests one of two things -- either shareholders of large-cap bank stocks are anxious, or traders are outright speculating on a drop for the fund. Either way, the stats are heavily skewed; currently, Schaeffer's put/call open interest ratio (SOIR) for XLF is 2.25, in the 85th annual percentile.

Likewise, during the past 10 days, traders on the International Securities Exchange, Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 6.55 puts for every call on XLF -- a ratio that registers in the 96th percentile of its annual range.

Even if we ascribe to this whopping appetite for XLF puts the tamest possible sentiment motive, we can at least surmise that finance stock longs are far from unhedged, and thus relatively unlikely to panic sell in the event of sector-unfriendly developments.

But having said that, it's possible that XLF could receive a boost if traders are forced to readjust their Fed expectations. Atlanta Fed President Raphael Bostic, who has generally skewed dovish in the current tightening cycle, told CNBC a few days ago that "The market is ahead of where I am" in terms of pricing in a September rate cut.

If forthcoming statements from the central bank fail to bolster rate-cut hopes, revised expectations for a sustained period of higher rates could draw more interest to big-cap lenders in the months leading up to Labor Day.