Despite maintaining bullish long-term positions in various resource, technology, and biotech stocks, Michael Murphy also sees some signs for caution; the editor of New World Investors is also a participant in the upcoming MoneyShow virtual event, August 3-5. Register for free here.

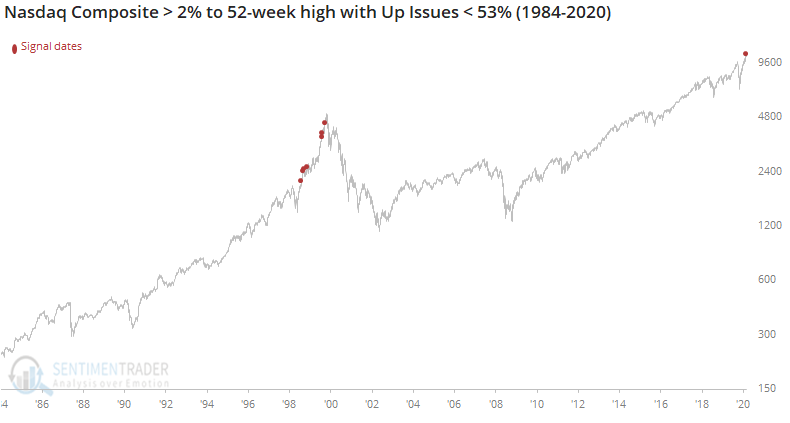

The Nasdaq Composite recently got over 10,800 — a 52-week high — and within shouting distance of 11,000. But on that same day fewer than 53% of the Composite’s stocks were rising.

That last happened in February 2000, and of the seven times it has ever happened, six of them were in 1999-2000. Is this the beginning of another melt-up?

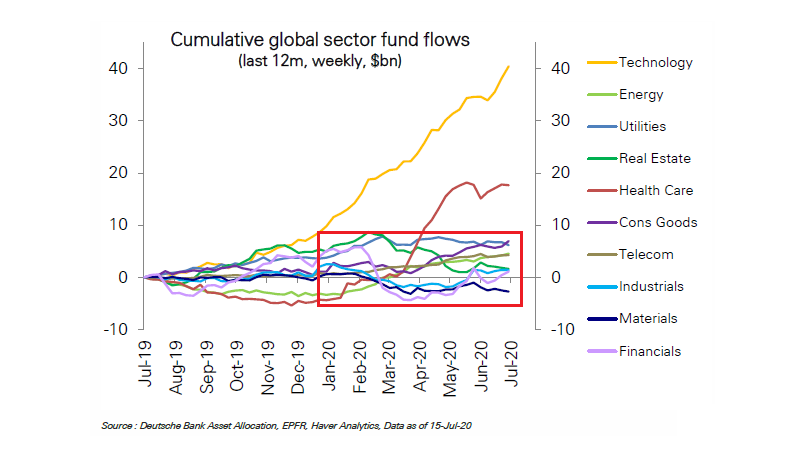

In the last 12 months, tech has had pretty much non-stop record inflows while the other sectors languished.

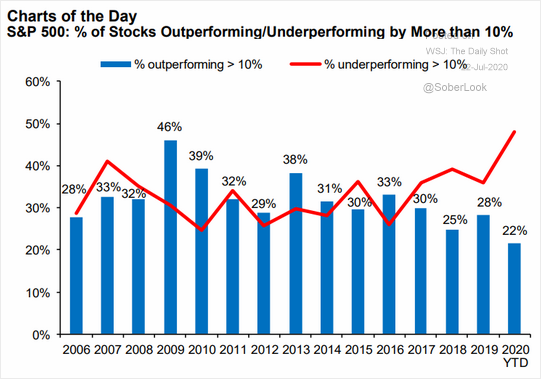

As a result, half the stocks in the S&P 500 are lagging the index by over 10%. Only 22% are outperforming by more than 10%. Such a divergence is highly unusual.

Market breadth is important, especially when we are entering a seasonally weak period. I think tech companies would have to produce blowout earnings reports to avoid an S&P 500 drop to the 38.2% retracement level at 2835.

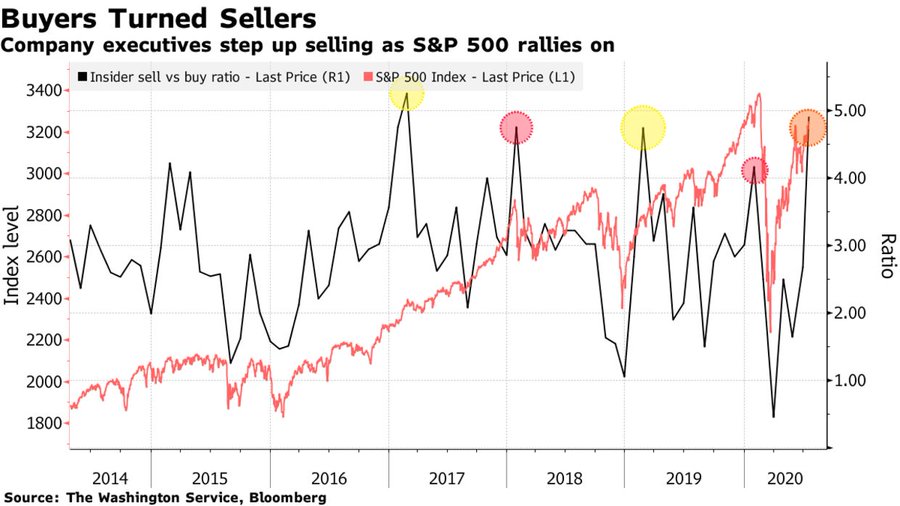

Insider selling also is very high. Almost 1,000 insiders have sold shares of their own companies in July, outpacing insider buyers by a ratio of 5-to-1. Only twice in the past three decades has the sell-buy ratio been higher than now.