Business Development Companies — known as BDCs — allow everyday retail investors the opportunity to invest indirectly in small and mid-size businesses, explains dividend investing expert Bob Ciura, contributing editor to Sure Dividend.

Previously, investment in early-stage or developing companies was restricted to accredited investors, through venture capital. And, BDCs have obvious appeal for income investors.

BDCs widely have high dividend yields above 5%, and many BDCs pay dividends every month instead of the more typical quarterly payment schedule.

Of course, investors should consider all of the unique characteristics, including but not limited to the tax implications of BDCs. Investors should also be aware of the risk factors associated with investing in BDCs, such as the use of leverage, interest rate risk, and default risk.

Main Street Capital (MAIN) provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies.

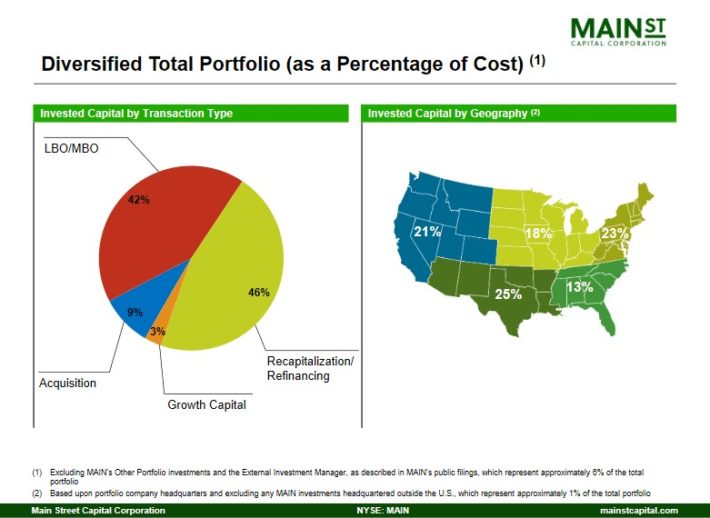

Main Street defines lower middle market companies as generally having annual revenues between $10 million and $150 million. The company’s investments typically support management buyouts, recapitalizations, growth financing, refinancing and acquisitions.

Source: Investor Presentation

As of the end of 2020, Main Street had an interest in 70 lower middle market companies, 42 middle market companies and 63 private loan investments. The company has a market capitalization of $2.4 billion, and generated $138 million in net investment income last year.

On February 26th, Main Street Capital released fourth quarter results. Net investment income of $39.6 million was a 1% increase compared to $39.2 million a year ago.

Main Street generated net investment income per share of $0.59, down 5% from last year’s income of $0.62. Distributable net investment income per share totaled $0.63, down 5% from $0.66 in the fourth quarter of 2020.

For the full fiscal 2020, MAIN generated $2.10 per share in net investment income, which was down 16% from $2.50 in 2019. Distributable net investment income of $2.26 was down 15% from $2.66 in the year prior.

Main Street has put together a solid record in the past decade. From 2011 through 2020, Main Street was able to grow net investment income by an average compound rate of 2.4% per year, despite the pandemic weighing on 2020 results. From 2010 to 2019, NIIPS grew 8.9% per year.

Main Street is an attractive dividend stock, not just because of its 6%+ yield, but also because Main Street is a monthly dividend-paying stock.

Ares Capital Corporation (ARCC) is a specialty finance BDC. It focuses on generating both current income and capital appreciation through debt and equity investments. The company invests primarily in U.S. middle-market companies, as well as larger companies.

Its portfolio is comprised of first and second lien senior secured loans as well as mezzanine debt, diversified by industry and sector. The company was founded in 2004 and has a market capitalization of ~$8 billion.

Source: Investor Presentation

ARCC reported its Q4 results on February 10th. Core earnings-per-share came inat 54 cents, up from 45 cents in the year-ago quarter. Total investment income came in at $440 million, up from $386 million year ago.

Ares Capital recently made new investment commitments of $3.9 billion, $3.1 billion of which were funded. Of the investments made, 20 are new portfolio companies while 38 are existing portfolio companies.

Fourth-quarter net interest income increased to $46.1 million from $$33.8 million year-over-year. Excluding gains and losses on derivative instruments, agency business generated revenue increased to $125.6 million from $81.8 million in Q3. Structured business portfolio increased 7.4% to $378.2 million in Q4.

Meanwhile, net asset value per share decreased from $17.32 in the year-ago period to $16.97 as of December 31, 2020. The company’s fair value portfolio investment as of December 31 amounted to $15.5 billion inclusive of accruing debt and other income producing securities of $13.7 billion.

Ares Capital is arguably the safest BDC given that its balance sheet is in a very strong position with solid and stable asset quality and a diversified long-duration liability structure.

It also has very diversified holdings with strong interest coverage, which reduces default risk. Its competitive advantage comes from its superior size and scale as one of the largest BDCs. Shares have an attractive dividend yield above 8%.