Technology was the one of the few shining stars during the darkest days of the COVID-19 pandemic, observes growth investing expert Jim Woods, editor of The Deep Woods.

Indeed, as a sizable percentage of the American population shifted into work-from-home mode, technology companies saw their earnings per share (EPS) sharply rise. Concurrently, the tech-heavy Nasdaq repeatedly hit new highs.

Since the start of 2020, the Nasdaq Composite has risen more than 50%. As the old saying goes, however, “what goes up must come down.”

Technology stocks then had a very weak first quarter in 2021, as investors started to move funds into value stocks and other companies that were leveraged toward the reopening of the economy. The result was an inevitable correction in the technology sector.

This does not mean, however, that the sector should now be totally set aside. Technology is still in a growth pattern, as some of the trends that were occurring before the pandemic are now accelerating and some of the changes that were impelled as a result of the pandemic are now becoming permanent, or at least protracted.

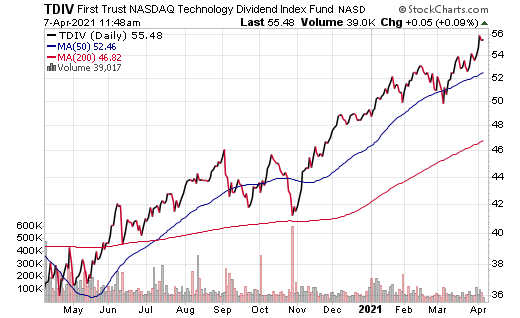

Due to the recent pullback in the technology sector and the onset of earnings season, it is time to turn our attention to the First Trust NASDAQ Technology Dividend Index Fund (TDIV).

In order to sift through the bounty of technology companies that are out there, this exchange-traded fund tracks a dividend-weighted index of U.S.-listed stocks that provide regular payouts.

All companies in the fund are weighted according to their dividend yield relative to other stocks in the portfolio, and then adjusted so that technology companies make up 80% of the fund. Telecom companies make up the other 20%.

Some of this fund’s top holdings include Cisco Systems (CSCO), International Business Machines (IBM), Microsoft (MSFT), Apple (AAPL), Broadcom (AVGO), Oracle (ORCL), Texas Instruments (TXN) and Intel (INTC).

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of April 6, TDIV has been up 8.21% over the past month and up 12.30% for the past three months. It is currently up 12.39% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $1.51 billion in assets under management and has an expense ratio of 0.50%. In short, while TDIV does provide an investor with a chance to tap into the world of technology, this kind of ETF may not be appropriate for all portfolios.

Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.