We have a rare opportunity to buy blue-chip Kinder Morgan (KMI) at a discount to its growing dividend, suggests Brett Owens, income expert and editor of Contrarian Income Report.

The stock is still in purgatory after its December 2015 dividend cut. We contrarians can keep clearer heads because we were bearish on energy dividends from 2014 to 2020. We didn’t simply stare at the yields and hope they stayed put as energy prices declined. We stayed out of the fray.

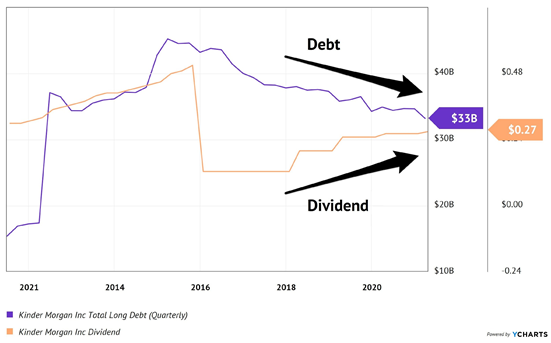

Kinder has quietly been mounting a comeback. In fact, its 2015 dividend moment was its darkest. Debt levels also peaked in that year, and the company has paid down nearly 30% of the money it owed in the next six years:

Kinder Saves Cash, Repays Debt, Raises Dividend

As I write, the firm’s net debt levels are just four times EBITDA. Management’s goal was to work debt down to four-point-five-times EBITDA, so it has already exceeded the plan that was put into place six years ago. Which means Kinder now has some extra kindling for dividend increases and share buybacks.

A few weeks ago, management did in fact raise its annual dividend by 3%. It’s the fourth payout increase since 2018 and arguably the most impressive, given the year we all just had.

Income investing may not be easy, but it isn’t brain surgery either. Over time, stock prices follow their dividends—for better and for worse! Kinder has been no different. Look at its meandering stock, following around its payout like a puppy dog.

As this bargain climbs out of the basement, we see the stock actually has some “catching up” to do with respect to its dividend. Income investors haven’t fully warmed up to Kinder yet, which provides us composed contrarians with an opportunity to buy these shares before they do.

Now, before we look more closely at the negative 10-year numbers above, let’s consider two important points:

• Kinder is going to make money when energy prices are steady or better. We plan to own the stock for the next few years while energy prices climb.

• We need to consider Kinder’s prospects on a total return basis, one that includes dividend payments.

In this light we see that, while the firm has doubled its dividend since 2018, its total return is lagging. This holdup is a good thing. It gives us a chance to buy shares at a significant discount now.

Plus, management has $1.4 billion left on its existing share repurchase authorization. If and when executed, that would remove 3.4% of the stock’s outstanding float.

With debt under control and the dividend already hiked for the year, it will be a dealer’s (management’s) choice as to whether the money goes to buybacks or capital projects for the rest of the year.

We’ll let them calculate expected returns while we collect this dividend and watch its magnet pull this inexpensive stock price higher. Action to Take: Buy Kinder Morgan up to $19.50.