The SPDR S&P Biotech ETF (XBI) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Biotechnology Select Industry Index, reports Jim Woods, fund expert and editor of The Deep Woods.

The exchange-traded fund (ETF) seeks to provide exposure to the Biotechnology segment of the S&P TMI, which comprises Biotechnology sub-industries that combine to track a modified equal-weighted index. The ETF offers the potential for unconcentrated industry exposure across large-, mid- and small-cap stocks.

Since the fund equal-weights its portfolio, it in turn emphasizes small- and micro-caps and greatly reduces single-name risk. Thus, the weighted-average market cap is much smaller than some competitors'.

Unlike other funds in this segment, XBI is a pure biotech play, with relatively small pharma overlap. The index is rebalanced quarterly. Plus, the fund allows investors to take strategic or tactical positions at a more targeted level than traditional sector-based investing.

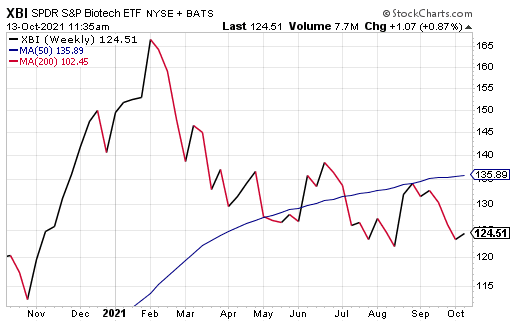

XBI trades around $124 a share and has a 0.24% dividend yield. It also has a 0.2% average spread, 189 holdings and a 0.35% expense ratio, meaning it is relatively inexpensive to hold in comparison to other exchange-traded funds.

Source: StockCharts.com

Although XBI’s share price has been in a bit of a slump, this gives potential investors a great opportunity to buy shares in this hot ETF at a discounted price.

However, as with any opportunity, I urge all potential investors to exercise their own due diligence in deciding whether this fund fits their own individual portfolio goals.