Investors are likely reviewing their strategies as we enter the most bullish six-month period for the S&P 500 Index, observes Fernanda Horner in Schaeffer's Investment Research.

One name that has historically outperformed this time of year is big box retailer Costco Wholesale Corporation (COST). The company is one of the 25 best performers in November going back 10 years, according to a new list compiled by Schaeffer's Senior Quantitative Analyst Rocky White.

The security hit a fresh all-time high; this bull gap came after Costco stock earned no fewer than eight price-target hikes, with the highest one coming from Jefferies to $580 from $525, on the heels of its upbeat sales results for October.

White's data shows COST ending the month higher in each of the past 10 years, while averaging a 5.1% return. This places the equity among the top 10 names with the best one-month returns, and also makes it the best retailer on the list.

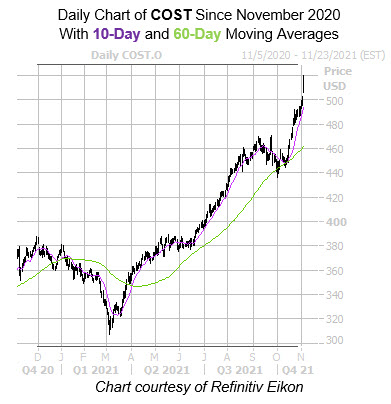

A similar move from Costco stock's current perch would help the equity notch yet another record high, just shy of the $544 mark. The security has been charging higher since the 60-day moving average captured a pullback in early October.

Newfound support at the 10-day moving average has also been guiding the shares higher over the last few weeks. Year-over-year, COST has amassed a 41.3% lead.

The options pits are bullish towards COST. The stock's 10-day call/put volume ratio of 1.93 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) sits higher than all but 6% of readings in its annual range. In other words, calls are getting picked up at a much quicker-than-usual pace.

Drilling down to today's options activity, 41,000 calls and 19,000 puts have crossed the tape so far, which is double the intraday average.