Eagle Point Credit Co. (ECC) is an undervalued high-yield pick that is excellent to hold in an inflationary environment; it is set to benefit if the Fed raises rates, explains Rida Morwa, editor of High Dividend Yields.

Leveraged loans and their CLO tranches are floating-rate instruments priced at a spread above a benchmark rate (the LIBOR). As interest rates fluctuate, CLO yields move up in sync. CLO floating-rate yields make them an effective hedge against inflation, making them highly desirable for income investors.

Many investors run away from leveraged loans due to their conceptual similarity to CDOs and MBS, responsible for the Great Financial Crisis ('GFC'). But CLOs present far lower risk than corporate debt, and other securitized products do. It is noteworthy that no AAA or AA CLO tranche has ever experienced principal loss.

Eagle Point Credit Co. is a closed-end-fund (CEF) composed of equity and junior debt tranches of CLOs and is managed by the competent and experienced Eagle Point Credit Company. The firm is top-rated for leveraged loans and was recently awarded "Best Closed-End CLO Fund" by Creditflux, a leading global information source covering credit funds and CLOs.

ECC's November update reported NAV in a range of $13.56-$13.66, down from $14.23-$14.33 in October. The irrational Mr. Market interpreted this as bad news and lowered the stock. Objectively looking at the loan market, November was a record-breaking month for loan issuance in a record-breaking year. Loan issuance has smashed all prior records.

As a result, loan managers' portfolios were full. They couldn't buy more loans without freeing up cash by selling off the loans they had on the books. This in turn caused a massive spike in new CLOs issues. After averaging $15 billion per month through October, November saw $25.6 billion in new CLOs issued.

Every new CLO issued means a new equity position that the loan manager is trying to dump into the market. It doesn't take an economist to conclude that prices decline when there is higher supply than demand.

Following the GFC, debt markets were forced to reevaluate and make their underwriting practices more stringent, effectively increasing coverage ratios. This makes CLOs very structurally sound and safe income investments. Fitch's projects CLO default rates to be 1.5% for 2022, down from 2.5-3.5% projected earlier this year.

ECC's NAV growth has been beyond impressive in 2021. As a result of stellar performance, the CEF declared a $0.50/share special dividend to shareholders.

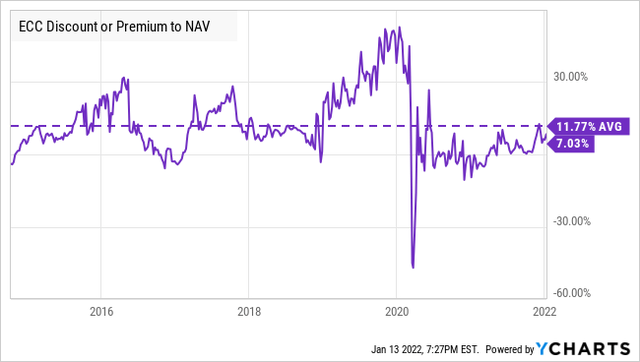

ECC has been a rewarding income investment over the years. Since its IPO in 2014, ECC has paid $14.9 in cumulative common distributions. That is a 78% total return in 7 years, without any dividend reinvestment. Today, this CEF trades significantly below its lifetime average premium to NAV. This is a rare opportunity for investors, given the demand for CLOs is at its highest today.

ECC's $0.12/share monthly dividend calculates to a 10.2% annualized yield. Being floating-rate instruments, CLOs inherently benefit from rising rates, and ECC's generous dividend is an excellent inflation hedge. All in all, a fantastic addition to your income portfolio in today's volatile, inflation-stricken, yield-less market.