Focused on a combination of technical and sentiment-based trading strategies, Bernie Schaeffer is a long-standing industry leader in options trading. Here's a look at a trio of retail stocks featured in Schaeffer Research's Option Advisor.

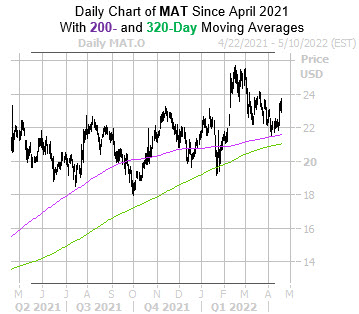

Toy manufacturer Mattel (MAT) is up 10% in the last 12 months, while also sporting a 6.4% year-to-date lead, with converging support at its 200- and 320-day moving averages.

Those trendlines happen to match the equity's 2022 breakeven level, which acted as support in early April. In other words, now looks like an ideal time to speculate on Mattel stock’s next move with calls.

The security looks ripe for a short squeeze, given short interest makes up 6.8% of MAT’s available float, or more than one week’s worth of pent-up buying power.

A shift in the options pits could also send shares higher. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MAT's 50-day put/call volume ratio stands in the 96th percentile of annual readings.

RECOMMENDATION: Buy the Mattel July 15, 2022 22-strike call.

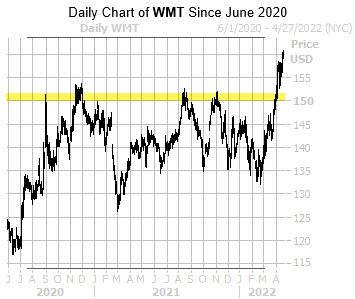

Retail powerhouse Walmart (WMT) has surged over 10% in 2022 despite a myriad of global supply chain issues. The company’s expansive size acts as leverage, giving the company a leg up among competitors like Target (TGT).

On the charts, the shares recently broke above a trendline of resistance at the equity’s November 2020 highs, as well as its August-November 2021 ceiling near $150.

TD Ameritrade net sellers were heightened November through February 2022, and an unwinding of this pessimism could send Walmart stock even higher.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), WMT's 50-day put/call volume ratio ranks higher than 95% of readings in its annual range — its highest level since April 2020. This means that puts are getting picked up at a much quicker-than-usual pace, and an unwinding of these bearish bets could push WMT higher.

RECOMMENDATION: Buy the Walmart July 15, 2022 155-strike call.

Our suggested strike for luxury apparel retailer Nordstrom (JWN) is perched right near its 200-day moving average, which is an area the shares have conquered and successfully retested over the past month.

The stock also gapped higher after the company posted an early-March quarterly earnings beat, and issued an impressive 2022 forecast, sending JWN’s year-to-date gains above 22%.

Analysts are extremely pessimistic toward the equity, leaving ample room for upgrades, should this bearish sentiment begin to unwind. Specifically, all 10 covering brokerage firms recently carried a tepid "hold" or worse recommendation.

Nordstrom stock also looks to be sporting higher-than-usual implied volatility (IV), as well as put open interest (OI) that exceeds call on open interest.

RECOMMENDATION: Sell the Nordstrom May 20, 2022 22.50-strike put.