Founded in 2012 and based in Oxford, England, Exscientia (EXAI) is using artificial Intelligence (AI) to develop new medicines as fast as possible. It is attracting high quality partners and the company is turning this into explosive growth, exclaims Carl Delfeld, editor of Cabot Explorer.

You have probably heard more than you want about the incredible potential of artificial intelligence. AI enables computers, robots, and other devices to think like humans but far faster and more powerfully. Therefore, it is sometimes referred to as machine learning. The potential of AI can be applied to many industries but perhaps the most exciting is the field of medicine.

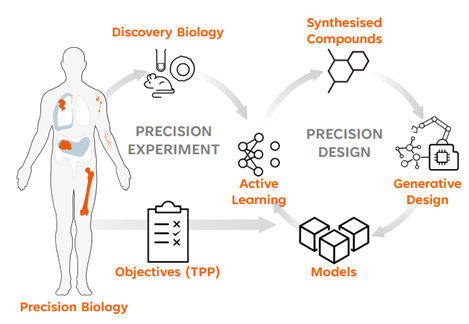

Exscientia has the first AI platform clinically validated to improve treatment outcomes for cancer patients and boasts the world’s first AI-designed drugs to enter clinical trials. It has a rapidly growing pipeline of more than 30 projects in motion with the goal of drug discovery in ovarian and hematological (blood) cancer.

In terms of partnerships, a year ago it signed a $5.2 billion collaboration with French drug giant Sanofi (SNY). It has also expanded a Bristol-Myers Squibb (BMY) collaboration to include drug targets in both immunology and oncology. This is on top of a design partnership with a French drug giant, Germany’s Bayer, and Japan’s Sumitomo Dainippon.

Exscientia is the world’s recognized leader in the field and when it announced its third-quarter results last November, it reported solid progress. (The company will report Q4 results on March 23.)

Moreover, Exscientia announced a partnership with The University of Texas MD Anderson Cancer Center, a premier cancer research and treatment center, to develop small-molecule therapies in oncology. It also produced accurate protein modeling up to 35,000 times faster than AlphaFold 2, an AI program developed by DeepMind, a subsidiary of Alphabet (GOOGL).

It should be noted that Exscientia is not currently profitable, nor will it be this year. However, the company has an ample cash position exceeding $600 million and has an annual net cash burn rate of only about $15 million.

With a market cap of $1.3 billion, the company is selling for just over two times its cash on hand. The stock is also in a nice uptrend. This is an aggressive company and sector, but EXAI offers exceptional upside potential.

Recommended Action: Buy a half position in EXAI.