Today, I’m going to talk about the similarities between the U.S. debt ceiling crisis and Godzilla – and how investors can prepare for default with the ProShares Ultra Gold (UGL), the most liquid, double-leveraged gold ETF, writes Sean Brodrick, editor at Weiss Ratings Daily.

America is zip-lining into Godzilla’s mouth again — something you can totally do in Japan right now, by the way, at a theme park on an island near Kobe, Hyōgo Prefecture (where the famed beef comes from).

Does that sound like fun? I’d say it sounds insane … much like the US debt ceiling battle.

Like Godzilla, US debt keeps getting bigger. When Godzilla first stomped onto the silver screen in 1954, he was scaled to be 50 meters (164 feet) tall. This was done so Godzilla could just peer over the largest buildings in Tokyo at the time.

The buildings in Tokyo have gotten bigger, so Godzilla has grown in size in successive movies. And once Hollywood got a hold of him, Godzilla eventually grew to 122 meters (400 feet) tall.

Well, the US debt keeps growing, at least in nominal terms, and has done so every year for the past 10 years. It now stands at $31.7 trillion.

Under President Biden, the debt has grown 13.3%, up from $27.77 trillion. If you’re looking for a bright side, US debt as a share of GDP is now 94%, down from the 105% it was during the Trump administration. Still, that’s WAY too big.

And like Godzilla, the US debt’s bite is quickly getting worse. That’s due to the Fed’s course of raising interest rates to a 16-year high! This is raising the cost of servicing the national debt to monstrous proportions.

By that, I mean interest payments on the national debt were $475 billion in fiscal year 2022 — the highest dollar amount ever. That was up 35% from 2021!

Does that sound bad? Well, this year, interest costs are projected to grow ANOTHER 35%! And if we stay on this course, we are in for a world of hurt. By 2033, the Congressional Budget Office says that we’ll spend $1.4 trillion a year just servicing the debt!

So, both sides in Washington can agree to cut some spending. But if the Fed doesn’t start cutting interest rates, we could end up in worse debt trouble anyway. We’ll see what happens in the coming days as debt ceiling negotiations continue.

In the meantime, what can you do as an investor? We’ve seen America default briefly on the debt before in 2011. When that happened, the stock market tanked. At the same time, gold soared, reaching the then-all-time high of $1,920/ounce.

I’m not saying history will repeat. But the thing about those old Godzilla movies is they often follow similar plotlines. UGL could perform very well in a default scenario.

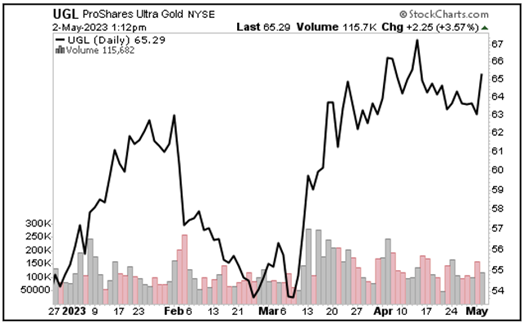

The ETF is up over 44% in the past six months, and if gold can break out of the range it’s been in since March, the UGL will blast off.

Recommended Action: Buy UGL