In the more than 70 years since hedge funds were first brought to market by Alfred Winslow Jones in 1949, they’ve become ubiquitous in the investing industry. I like to look off the beaten path to see which smaller-cap companies the best hedge funds are buying, and one such stock is Turtle Beach Corp. (HEAR), writes Nancy Zambell, editor at Cabot Money Club.

Hedge funds might not be an investment vehicle for investors like most of us. After all, the minimum investments typically range from $100,000 to $2 million. But if you follow Wall Street, you’re likely familiar with hedge funds and the impact they can have on stock prices. Case in point: Hedge funds currently own about 7% of the stock market.

It is possible to see what these well-heeled institutions are buying, too. As you might expect, many are buying the typical tech stocks, like Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META). Those shares are all fine and good, and most of us should have a few of those stocks in our portfolios.

But personally, I reviewed about 25 smaller stocks and came up with one that looked interesting: HEAR. Turtle Beach is a leading gaming headset and audio accessory brand, operating in North America, Europe, the Middle East, and the Asia-Pacific region.

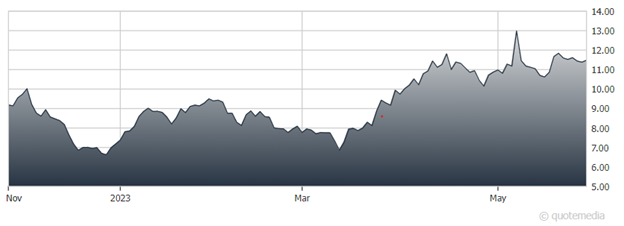

Turtle Beach Corp. (HEAR)

The company also offers gaming accessories, such as keyboards and mice, under the ROCCAT brand. Turtle Beach recently announced that its board has authorized an extension of the share repurchase program for an additional two years, now running until April 9, 2025. The program allows the company to repurchase up to $25 million worth of its common stock.

Analysts have a Buy rating on shares of Turtle Beach, with a price target of 16. Wall Street expects a 15% increase in full-year sales and a $20 million improvement in adjusted EBITDA.

Recommended Action: Buy HEAR