Through extensive in-house research, we find high-quality companies with consistent, above-average growth and durable competitive advantages. FactSet Research Systems (FDS) is one that makes the cut, writes Ingrid Hendershot, editor of Hendershot Investments.

FDS recently reported revenues for the third fiscal quarter ended May 31, 2023. They increased 8.4% to $529.8 million, while net income and EPS increased more than 79% to $134.7 million and $3.46, respectively.

Adjusted earnings and EPS, which exclude last year’s charges related to restructuring and business acquisition costs, increased 1.8% and 0.8%, respectively. Annual Subscription Value (ASV) plus professional services was $2.1 billion at May 31, 2023, compared with $2.01 billion at May 31, 2022.

Organic ASV plus professional services, which excludes the effects of acquisitions and dispositions completed within the last 12 months and foreign currency movements, was $2.1 billion at May 31, 2023, up $156.6 million from the prior year at a growth rate of 8.0%. Annual ASV retention was greater than 95%.

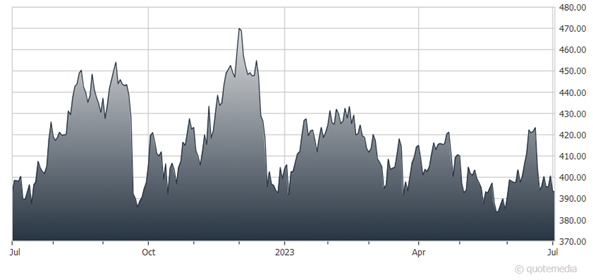

FactSet Research Systems (FDS)

Client count as of May 31, 2023, was 7,770, a net increase of 40 clients in the past three months, primarily driven by an increase in corporate and wealth management clients. User count increased by 1,382 to 187,845 in the past three months, driven by an increase in asset management, asset owner, and wealth management users.

During the quarter, FactSet Research generated $218.6 million in operating cash flow, up 14% from last year, while free cash flow increased 9.1% to $192.6 million, driven by working capital efficiencies as well as the timing of income tax payments.

FactSet recently increased the dividend by 10%, marking the 24th consecutive year of dividend increases. During the quarter, FactSet repurchased 165,950 shares of its common stock for $67.1 million at an average price of $404.29 under the company’s existing share repurchase program, with $114.2 million remaining for share repurchases under this program. FactSet’s board recently approved a new share repurchase authorization of up to $300 million, which will be available on September 1, 2023.

FactSet ended the quarter with $518.8 million in cash and investments, $1.7 billion in long-term debt, and $1.7 billion in shareholders’ equity.

Recommended Action: Buy FDS.