The Dividend Aristocrats are the “best of the best” dividend growth stocks. They have a long history of outperforming the market, and one that passes our screens is Albemarle (ALB), writes Bob Ciura, contributing editor at Sure Dividend.

Dividend Aristocrats are elite companies that satisfy the following:

- Are in the S&P 500 Index

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size and liquidity requirements

All Dividend Aristocrats are high-quality businesses based on their long dividend histories. A company cannot pay rising dividends for 25+ years without having a strong and durable competitive advantage.

But not all Dividend Aristocrats make equally good investments today. Some Dividend Aristocrats are better than others, based on the sustainability of their dividends.

That’s why we recently analyzed the 10 safest Dividend Aristocrats from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system. ALB is one with a Dividend Risk Score of ‘A’, the top rating, and with the lowest payout ratio (6.9%).

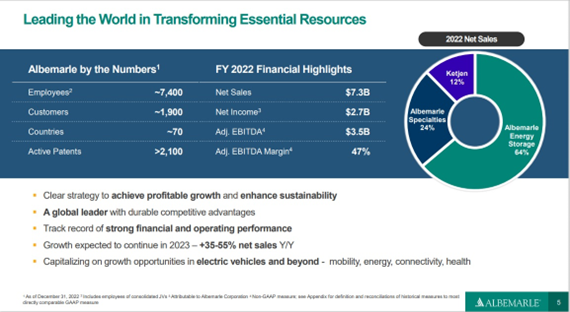

Albemarle is the largest producer of lithium and second-largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the US and Chile. The company has two joint ventures in Australia that also produce lithium.

Source: Investor Presentation

On May 3, Albemarle announced first-quarter results. For the quarter, revenue grew 128.3% to $2.58 billion, but this was $160 million less than expected. Adjusted earnings-per-share of $10.32 compared very favorably to $2.38 in the prior year and was $3.26 above estimates.

Recommended Action: Buy ALB.