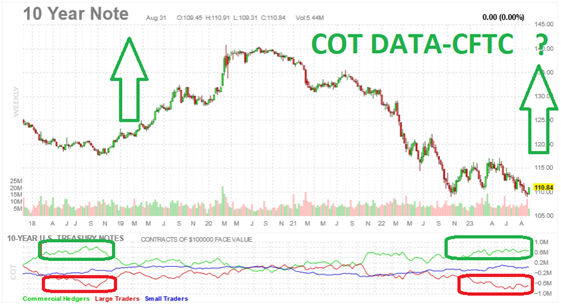

What’s ailing the market? Interest rates. On Aug. 18, there were big headlines that a “major manager” had just put a huge short on bonds – expecting yields to blow out. But on our podcast that day, we said that this particular hedge fund manager probably called the bottom in bonds and the top in rates by “shorting in the hole” one of the most crowded trades in history, explains Tom Hayes, founder of Hedge Fund Tips.

Sure enough: With the exception of one day, yields have stayed below the level when the “big announcement” was made. We anticipate that will persist and it has broad ranging implications – which we discussed in extensive detail in recent media appearances.

The blue horizontal line represents the day the headlines hit that the “major manager” announced his bond short. If you look at the black line – which represents the iShares 20+ Year Treasury Bond ETF (TLT) – you’ll see that it was a near bottom tick.

Perhaps this manager will turn out to be correct, but we’re going to take the other side of this crowded trade by burdening ourselves with the facts. The facts are that when everyone is thinking alike, they are probably not thinking.

The red line represents the large traders/speculators/hedge fund managers who think they see something no one else does. The problem with this is the fact that EVERYONE is crowded short into the same trade – just like they were in 2018 before we had a monster rally in the 10yr (compression in yields). I do not expect that magnitude of a rally, but we are looking for the trend to reverse in coming weeks and months.

Recently, I joined Charles Payne on Fox Business to discuss this very idea and how to benefit from it. The play is not to buy long bonds, but rather to buy those equities which have been beaten down the most due to the movement in yields – despite maintaining revenue, earnings power, and cash generation. When the trend reverses in bonds, these equities will recover aggressively to intrinsic value.