Wall Street’s Q3 earnings season kicks into high gear this week. Despite the bleak forecast, there is a select group of companies poised to deliver explosive profit growth. Investors should consider buying Uber Technologies (UBER), writes Jesse Cohen, senior financial analyst at Investing.com.

Wall Street’s third quarter earnings season kicks into high gear this week, with some of the biggest names in the market set to report their latest results. Analysts expect Q3 S&P 500 earnings to fall 0.3% year-over-year, which, if confirmed, would mark the fourth consecutive quarter of annual earnings declines reported by the index.

While most of the focus will be on the mega-cap technology stocks, there are several fast-growing names set to enjoy explosive earnings growth thanks to surging demand for their products and services. One of them is Uber.

The ride-hailing giant has experienced a strong and sustained rally this year because it has proved that it can thrive in a challenging environment. In contrast with many other high-growth companies, Uber is generating solid profits and cash flow as more people use its transportation and food delivery services.

The next major catalyst is expected to arrive when Uber reports third-quarter earnings on Wednesday, November 8, and it is expected to shatter its sales record once again despite the existing inflationary and recessionary economic climate.

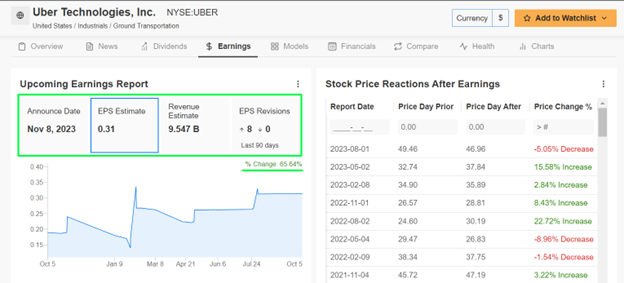

Wall Street is extremely optimistic ahead of the Q3 update, as per an InvestingPro survey, with analysts increasing their EPS estimates eight times in the past three months to reflect a gain of 65% from their initial expectations.

Uber Earnings

Source: InvestingPro

The ridesharing and delivery specialist is forecast to earn $0.31 per share, improving significantly from a loss of $0.61 per share in the year-ago period, thanks to ongoing cost-cutting measures and improving mobility trends.

Meanwhile, revenue is seen increasing 15% year-over-year to $9.55 billion. If that is in fact the reality, it would mark Uber’s highest quarterly sales total in its history thanks to strong demand from customers who continued to hail rides and order takeout food despite the current macro environment.

Shares of the San Francisco, California-based mobility-as-a-service company have run about 80% higher so far in 2023, far outpacing the comparable returns of major industry peer, Lyft (LYFT), whose stock is down 2% over the same timeframe.

Even with the recent upswing, UBER stock, which traded around $44 recently, could see an increase of roughly 19%, according to InvestingPro, bringing shares closer to their ‘Fair Value’ of $52.71.

Recommended Action: Buy UBER.

Get More Investing.com content from Jesse Cohen here...