Recent upward moves in stocks have taken the Dow Jones Industrial Average to just about where we started at the beginning of 2023. Meanwhile, the economy continues to show strength. I like to keep some steady, dividend-paying choices in this environment, and one worth considering is UnitedHealth Group (UNH), opines Nancy Zambell, editor of Cabot Money Club.

UnitedHealth Group is a Dow Jones component that is America’s largest insurer and one of the world’s largest private health insurers. It’s a goliath with $324 billion in annual revenues that serves 149 million customers in all 50 states and 33 countries.

That’s a lot of monthly insurance premiums! The group provides services at just about every facet of the healthcare process and the full-scale operation provides a powerful alignment of incentives that helps clients control costs better than competitors, which is a massive issue in the industry.

Delving deeper, UNH provides a wide range of healthcare products and services, such as health maintenance organizations (HMOs), point of service plans (POS), preferred provider organizations (PPOs), and managed fee-for-service programs. UNH has contracts with more than 1.6 million physicians and health professionals, as well as 8,000 hospitals across the US.

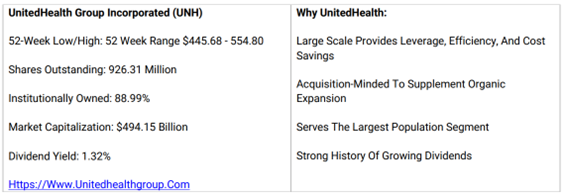

In its recent earnings report, the company raised its full-year 2023 earnings guidance to a range of $24.85 to $25 per share, up from its previous estimates of $24.70 to $25. Wall Street continues to be intrigued by UNH, boosting their earnings estimates for the company in the past couple of months.

UBS upgraded the stock to “Buy” last month and increased its price target for the shares to $640. The Street likes UNH’s steady fundamentals and its timely acquisitions in a fairly dead M&A healthcare space.

I also appreciate UNH’s continued dividend increases and think you would benefit, long-term, by adding these shares to your portfolio.

Recommended Action: Buy UNH.