Tyler Technologies (TYL) operates a vertically integrated software platform widely used by state and municipal governments to move necessary processes online. The modular nature of Tyler’s software means parts of the overall portfolio can be added on a piecemeal basis, explains Jon Markman, editor at Weiss Ratings Daily.

This appeals to counties large and small, everywhere from Los Angeles County, with a population of 12.9 million, to tiny towns in Texas of less than 100 citizens. The Plano, Texas-based company is the largest player in public sector software — a deeply fragmented segment.

Modules include courts and justice, public safety, appraisal and taxes, civic services, and K-12 schools. Company executives plan to accelerate growth by providing greater data analytics, a low code platform to help clients build bespoke applications.

The strategy is clearly working. Tyler reported $1.85 billion in revenues during 2022, with up to $1.95 billion projected in 2023. Some 80% of those sales are recurring, with an operating margin of 23.6%.

In November, executives estimated that the total addressable market for state, local, and educational software is $13 billion. The TAM for software devoted to the federal marketplace is $2 billion.

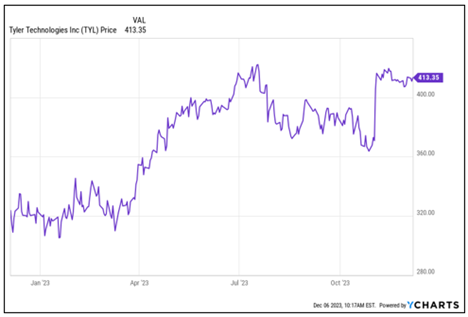

At a recent share price of $413, Tyler stock traded at 47.3 times forward earnings and nine times sales. These metrics reflect investors’ continued confidence in Tyler’s sticky revenue stream and strong growth prospects.

If you want to add some tech exposure that isn’t the trillion-dollar giants we hear about every day, consider this for your portfolio.

Recommended Action: Buy TYL