Have you ever considered quitting stock picking and just investing in an ETF that tracks an index of microcap stocks? After all, conventional wisdom says you should buy index funds like the iShares Micro-Cap ETF (IWC) and ignore stock picking altogether. But the reality is different, and I believe names like VAALCO Energy (EGY) may have more room to run, writes Nicholas Vardy, editor of Microcap Moonshots.

Holding index funds may hold water for large-cap stocks followed extensively by Wall Street analysts. But the argument does not hold water for microcap cap stocks.

Consider the Russell Microcap Index, a market cap-weighted equity index maintained by FTSE Russell and tracked by the above-mentioned ETF. Specifically, this ETF tracks the performance of the smallest 1,000 companies in the small-cap Russell 2000 Index (RUT) and the next thousand smallest eligible securities.

Last month, FTSE Russell posted its preliminary lists of companies set to join the Russell Microcap Index as part of its 36th annual Russell US Indexes Reconstitution. The annual Russell rebalancing involves a long list of companies, going into the hundreds.

Five microcap stocks will be added to the index this summer. As they are added to the index, each has the implicit “seal of approval from Wall Street analysts, with significant upside to their mean price targets.”

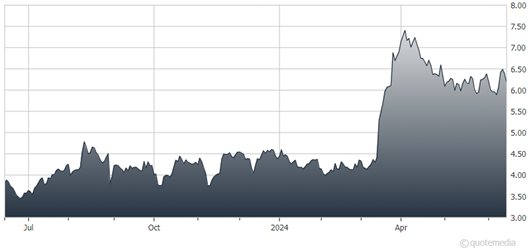

VAALCO Energy (EGY)

Yet if I run them through my Microcap Moonshots checklist, each and every one fails miserably. By my ranking, the very best stock has an overall ranking of 62. The worst has a ranking of 1 - the lowest possible ranking.

No wonder the IWC was recently down 1.7% this year. The lesson? Indexing works for large-cap stocks. But in the world of microcap stocks, stock picking is king.

As for EGY, it’s a stock that’s already had its “moonshot” moment. Thanks to crude oil’s move to over $100 per barrel, shares in this oil exploration and production (E&P) company have climbed more than 6x over the past two years. Even so, EGY stock may have more room to run.

Two factors could help this E&P firm hit higher prices...

First, if oil and gas prices hold steady and give back few of their gains, the company’s earnings may not drop next year, as is expected.

Second, operational improvements. These could help EGY generate more profits from its production properties in western Africa. The fact it's trading for just 3.25x earnings shows the market assumes VAALCO’s recent results will be a one-time event. If this proves not to be the case, it could continue to climb. Nothing suggests any issues with company health, bankruptcy risk, or earnings manipulation.

Recommended Action: Buy EGY.