At Berkshire Hathaway Inc.’s (BRK.A) annual meeting, Warren Buffett was asked the following: “If you had to start again at $1 million and achieve a 50% annual return, how would you invest?” This was his answer, explains Gav Blaxberg, CEO of Wolf Financial.

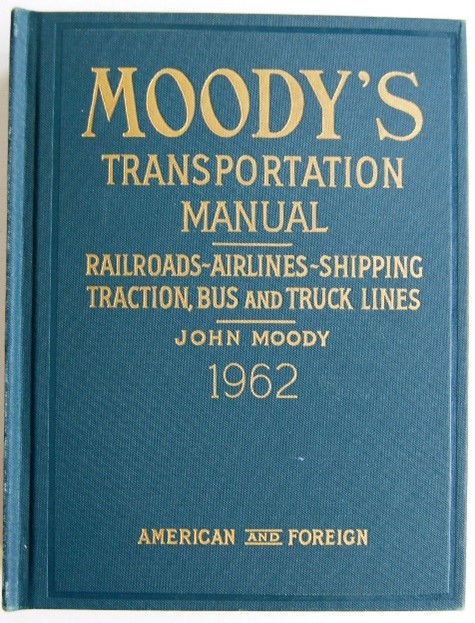

Buffett started by saying he’d thoroughly research small companies in extreme detail. Similar to how he used to study the 1,500-page Moody’s manual.

The problem is that reading a Moody’s manual isn’t very appealing. So, what’s the digital equivalent of Buffett's strategy?

The problem is that reading a Moody’s manual isn’t very appealing. So, what’s the digital equivalent of Buffett's strategy?

Start reading company financials, earnings reports, balance sheets, etc. Or perhaps the Bloomberg Terminal, SEC filings, S&P Capital IQ, stuff like that.

The point Buffett makes is that the money is in the details – unlike what many investors do by dollar cost averaging into ETFs without much thought. Nothing wrong with that approach, but it won’t get you 50% annual returns.

Buffett also emphasizes that this approach only works if you invest in topics you enjoy. Otherwise, the process is too boring to stick with in the long term.

Plus, if you don’t enjoy your research, you won’t go the extra mile. You won’t discover any hidden nuances about companies that’ll give you an investment edge. If you really want to beat the market by multiple factors, passion is a requirement.

Buffett’s strategy is simple: Do the boring yet essential activities that provide great returns. But make sure you’re investing in sectors you’re passionate about to offset the mundane aspects of investing. As cliche as it sounds, passion is everything.