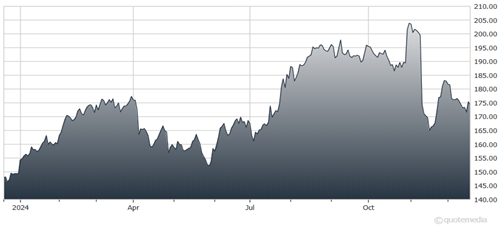

It looks like the election euphoria has run out of gas. The market has digested the vote and is now back to business as usual. Meanwhile, although AbbVie Inc. (ABBV) is down 17% from the October high, I really like the way the stock is setting up for next year, writes Tom Hutchinson, editor of Cabot Income Advisor.

The Dow Jones Industrial Average just lost ground for nine consecutive sessions. Most of the S&P 500 sectors have been down over the past month. Of course, the S&P is still within a whisker of the high. It hasn’t pulled back. But it hasn’t gone up in a while, either.

Investors are fretting about when the next Fed cut will be. November inflation came in stickier than expected and there is growing concern that the next rate cut could take quite a while. But things still look pretty good for 2025. The Fed is in a rate-cutting cycle that should last for the next two years. The economy is solid and expected to get stronger. And bull markets usually last a lot longer than this one has so far.

AbbVie Inc. (ABBV)

With ABBV, the downside catalyst was news that its schizophrenia drug flopped in Phase II trials. But that’s life with big pharma. ABBV was still up 12% year-to-date recently. That’s not bad considering this was supposed to be a tough year with shrinking revenues from the Humira patent expiration.

New immunology drugs Skyrizi and Rinvoq are expected to replace Humira’s peak revenues in a short period of time. In fact, management estimates that the combined revenue of these two drugs will be over $16 billion this year and $27 billion by 2027, far exceeding Humira’s peak sales.

Management expects the company to return to “robust” earnings growth next year, too. ABBV is getting through this tough year with flying colors ahead of greener pastures. Imagine how the stock will perform without a patent cliff and with strongly growing sales.

Recommended Action: Buy ABBV.