Shares of Copart Inc. (CPRT) dropped more than 11% after the company reported muted fiscal third-quarter volume growth. Still, this is a company that applies a very long-time horizon to its investments, and its track record has been excellent, notes Doug Gerlach, editor of Investor Advisory Service.

Revenue advanced 7%, as a 9% increase in service revenue was offset by a 2% decline in purchased vehicle sales. Global unit sales increased just 1%, as US insurance volumes fell by 1%. Copart noted it is experiencing a headwind from an increase in uninsured and underinsured drivers on the road.

Historically, the percentage of uninsured or underinsured drivers has been cyclical, and management expects a return to normalized levels over time. The company brushed aside claims from competitors that it is losing market share.

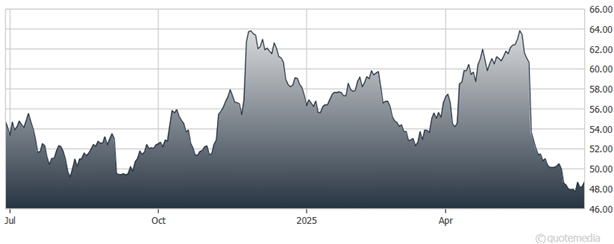

Copart Inc. (CPRT)

Total loss frequency jumped to 22.8% from 21.1% a year ago. The company expects the longer-term trend toward higher total loss frequency will persist, a positive for future growth. Volumes related to bank, rental, and fleet vehicles remained strong, up almost 14%, while dealer volumes increased 3%.

The heavy equipment auction space has been soft due to uncertainty regarding infrastructure spending and tariffs, resulting in flat overall transaction volumes for Purple Wave over the trailing twelve-month period. This has held back profitability as CPRT continues to invest to expand that business. Operating income advanced 5%, slower than top-line growth, due to incremental costs from hurricanes and investments to increase capacity.

Recommended Action: Buy CPRT