No one could fault an investor if at one point during the first half of 2025 they shouted, “Stop the world, I want to get off.” But now that the correction and first half of 2025 are over, what does history say awaits investors in the third quarter? Let’s take a look, writes Sam Stovall, chief investment strategist at CFRA Research.

Some 33% of all trading days in the first half experienced volatility of 1% or more, versus the 10-year average of 25%. During the first quarter, the S&P 500 also fell 4.6%, accompanied to the downside by mid- and small-caps, as well as the growth and value indices. The major contributing factor was the growing concern that the US would fall into recession as a result of the onerous tariffs placed on all major global trading partners.

During the second quarter, however, as investors concluded that the correction had overcompensated for this unjustified concern, the S&P 500 jumped 10%. That completed the opposite leg of the “V-shaped” hiccup, along with gains for both sizes and styles, plus eight of 11 sectors.

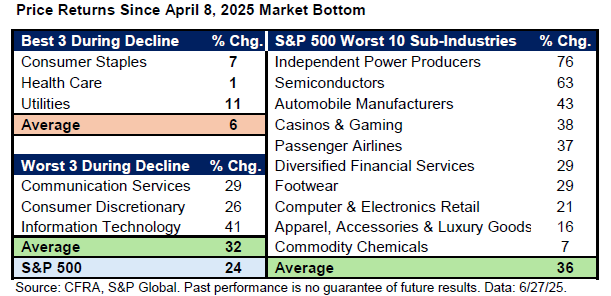

Since the April 8 low, true to history following the bottom of declines exceeding 10%, the S&P 500 has been outpaced by the three sectors and ten sub-industries that lost the most during the recent correction. Encouragingly, history indicates that quick drops to the -10% threshold typically result in a shorter and shallower total decline, followed by a more rapid recovery. This is exactly what happened.

So, what might happen next? Following corrections like we’ve just seen, since 1990, the S&P 500 typically posted a weak quarterly return, eking out only a 0.1% advance in Q3. Five of its 11 sectors posted declines, led by communication services, consumer discretionary, energy, and materials. Leaders were consumer staples, health care, and utilities.

Ongoing tariff negotiations, Middle East tensions, the possible passage of the deficit-adding One Big Beautiful Bill, and the earnings guidance offered or withheld during Q2 earnings reports will provide clues as to whether the upcoming Q3 will follow the traditional path of successive monthly weakness – or offer a period of continued post-correction gains accompanied by unusual calm.