Resilience. It’s a characteristic that we all aspire to, although some of us are better at being resilient than others. The stock market certainly was in the first half of 2025 – and one of my biggest winners most recently is semiconductor maker Texas Instruments Inc. (TXN), explains Jim Woods, editor of Investing Edge.

Because this is life, there are always forces intent on breaking even the most resilient among us. But as Hemingway famously wrote, afterward, some of us are strong at the broken places. I thought about this great line from A Farewell to Arms when I began digging through the details of the first half of the year in markets.

At the close of business on July 2, both the S&P 500 and Nasdaq Composite had hit respective all-time highs. Yet, if that’s all you knew about the first half of the year, my Hemingway reference would likely escape you.

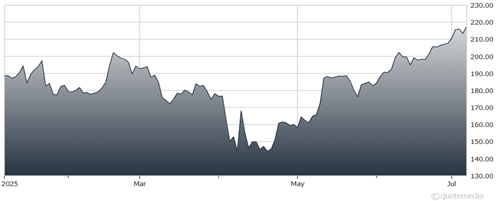

Texas Instruments Inc. (TXN)

For markets, the “broken place” came to us on April 2, and it came from the Rose Garden just outside the White House. Of course, you know I’m referring to those so-called “reciprocal tariffs.” The market plunged in response to this rather outrageous and confusing tariff scheme.

But after about a week of major distress in stocks and bonds, markets began the mending process on April 9. Since then, stocks have undergone a significant sprint higher up to those aforementioned new highs.

The conclusion here is that despite the big, broken misstep of April 2, markets have come back stronger than ever. That’s a condition that must not only be respected, but it must also be analyzed and understood. Even more importantly, it must be taken advantage of by you and your money – because if you aren’t fully invested now, when will you be?

That brings me to TXN. Last month, TXN shares spiked more than 14%, so this stock is definitely on a bullish roll. The TXN move shows the importance of having a technology stock in a dividend portfolio, because even though traditional dividend-oriented stocks aren’t typically from the tech sector, TXN is one of the very best exceptions.

We will find out how TXN does in terms of earnings when it reports results on July 22. I suspect we will see a really strong quarter, as voracious demand for all semis and tech pervades the current market and economic zeitgeist.

Recommended Action: Buy TXN.