It has become increasingly difficult to ignore the outsized gains many international ETFs have enjoyed in 2025. Here are two trade ideas to consider if you are seeking international exposure: The iShares International Select Dividend ETF (IDV) and the iShares MSCI EAFE Value ETF (EFV), advises Jeffrey Hirsch, editor-in-chief of The Stock Trader’s Almanac.

Tariff uncertainty, a weaker US dollar, and more favorable monetary policy are some of the likely drivers boosting international markets. IDV is one way to play it. This fund holds high-quality international companies that have generally provided consistent, high dividend yields over time.

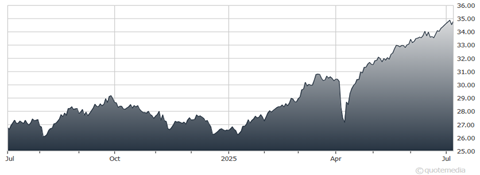

iShares International Select Dividend ETF (IDV)

It has over $5 billion in assets and has traded nearly 800,000 shares per day on average over the last 30 days. Its 30-day SEC yield as of April 30 was a solid 5.7%, while its expense ratio is so-so at 0.49%. Top holdings include British American Tobacco Plc (BTI), TotalEnergies SE (TTE), and Enel SPA (ENLAY).

As for EFV, it is a value-focused ETF that holds developed market equities outside of the US and Canada. EFV has over $25 billion in assets and its shares typically change hands millions of times in any given trading day.

Its expense ratio is okay at 0.33%, while its 30-day SEC yield is respectable at 3.48%. Top positions include Roche Holding AG (RHHBY), HSBC Holdings Plc (HSBC), and Nestle SA (NSRGY).