I like one counterintuitive ETF here. Why? Artificial Intelligence (AI) is deflationary by design – and that should make you bullish on the iShares 20+ Year Treasury Bond ETF (TLT), advises Luke Lloyd, founder and CEO of Lloyd Financial Group.

Everyone is hyped on how AI is boosting productivity and profit margins — but no one’s talking about what that means economically. AI is the most deflationary force since globalization.

Labor? Replaced or reduced. Decision-making? Automated. Cost structures? Crushed.

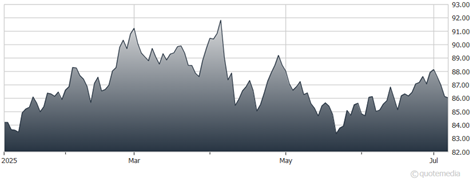

iShares 20+ Year Treasury Bond ETF (TLT)

This creates system-wide deflationary pressure, especially in white-collar-heavy sectors and service-driven industries. It may not show up in the Consumer Price Index today – but it will show up in wage flattening and long-end yield suppression over time.

As the Federal Reserve backs off, and the market wakes up to the real, long-term trajectory of inflation, long-duration Treasuries are the trade. They benefit from slower growth, lower inflation, soaring debt (because it constrains policy and suppresses yields).

Real rates are likely to fall, while nominal rates should fall even more. If you’re bullish on AI long-term, you’re inherently bullish on deflation — and TLT.