Shares of Doximity Inc. (DOCS) recently jumped 10% after a beat-and-raise Q1 FY26 report and news of a better-than-expected start to the upsell season. The quarter had more of what we wanted and less of what we didn’t, which is a good thing and came as a surprise to the market, highlights Tyler Laundon, editor of Cabot Early Opportunities.

On the call, management said customer marketing budgets are stabilizing, and while there is certainly some policy uncertainty out there, there is no slowdown in the business. Revenue grew 15.2% to $145.9 million (beat by $6.4 million), and adjusted earnings per share grew 28.6% to $0.36 (beat by $0.06).

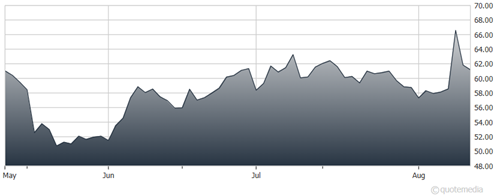

Doximity Inc. (DOCS)

Doximity’s AI suite is gaining momentum. The recently launched Doximity Scribe tool seems to be a hit. Plus, the just-announced $26 million Pathway acquisition gives docs free (for now) AI-powered clinical reference tools. Along with Doximity GPT, it can be used for note-taking, letter drafting, and addressing clinical questions. Look for management to discuss how this will all translate to revenue in the future.

FY26 revenue guidance goes up to $628 million - $636 million versus prior guidance of $619 million - $631 million, implying 11.6% growth at the high end.

Recommended Action: Buy DOCS.