The stock market just set new highs even as measures of the economy, like job creation, continued to cool. The lesson: Yes, the US stock market and the US economy are closely intertwined. Yet the makeup of earnings per share (EPS), which drives stock prices, differs in several key ways from the makeup of GDP, writes Sam Ro, editor of Tker.co.

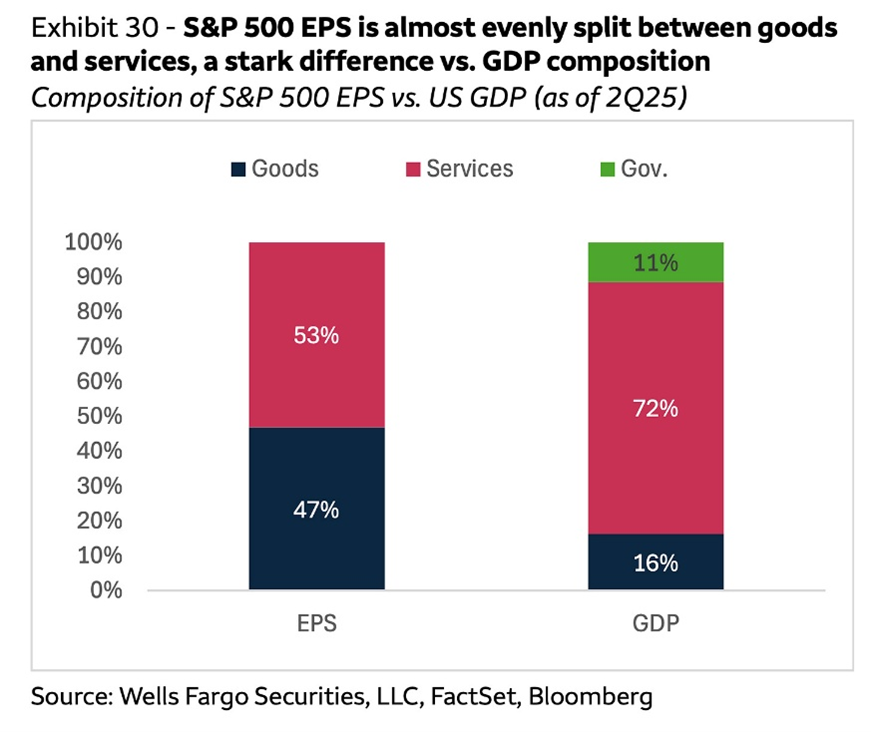

From Wells Fargo’s Ohsung Kwon: “Although EPS has been decently correlated to GDP (52% correlation since 1948), there is a key difference in the composition of S&P 500 Index (^SPX) EPS and GDP. The US economy is predominantly services-oriented, representing over 70% of GDP, but S&P 500 earnings are almost evenly split between services and goods/manufacturing.”

Meanwhile, one of the main reasons the US stock market has grown so large is that US companies have exhibited the best earnings growth for years. Some analysts expect this trend to continue.

From Morgan Stanley’s Katy Huberty: “Although YTD returns for US stocks have lagged globally, US stocks’ returns have been driven mostly by earnings growth, whereas earnings in Europe have been basically flat. European equities’ performance has been driven by multiple expansion and dividends. Looking forward, while earnings revisions breadth has turned up for all regions, the US revisions uptrend is by far the strongest.”

So, are we due for a pullback?

From Carson Group’s Ryan Detrick: “The S&P 500 just completed one of the best five-month rallies ever, up more than 30%. Since 1950, this only happened five other times, but the returns going out a year were much better than average. A year later? Never lower and up more than 18% on average.”