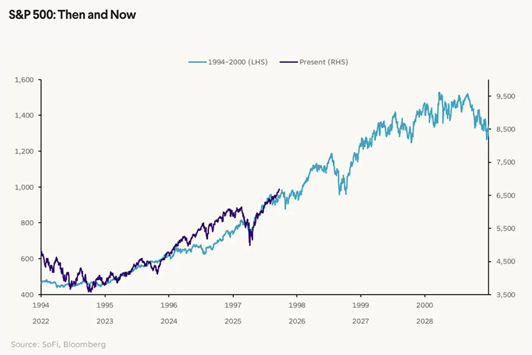

The S&P 500 Index (^SPX) added 1.3% in the last two weeks and hit a new all-time record Friday. It’s up 14.2% year-to-date – and AI-related stocks have accounted for 75% of S&P 500 returns. If the AI revolution plays out like the dotcom revolution, as I expect it will, the underinvested have a few years of pain ahead, observes Michael Murphy, editor of New World Investor.

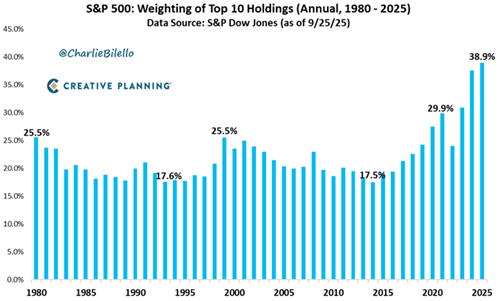

AI stocks have also accounted for 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022. The top 10 holdings in the S&P 500 now make up nearly 39% of the index, the highest concentration on record.

But there are still a lot of “underinvested.” Goldman Sachs’ Sentiment Indicator, which measures US equity investor positioning across retail, institutional, and foreign investors, has rebounded to -0.6 from its low of -0.9 four weeks ago. But it’s negative.

Not one of the nine positioning measures in the indicator are in “stretched” territory. Goldman says that readings below -1.0 or above +1.0 indicate extreme positions that are significant in predicting future returns.

When will we see that sideline money flow in? Citadel Securities’ Retail Equity client seasonal demand trends from the last eight years show that September is the weakest, October builds, and November builds more. January is huge.

This is not just a US bull market. Global stock market breadth is not just positive, it is relentless. A 73-day streak of more new highs than new lows marks the strongest run of worldwide participation since May 2021.