In a market high on AI hype and $10 billion chip orders, one of the best-performing stocks sells toilet paper in bulk. If you’re judging by long-term ownership, investor trust, and consistent outperformance with zero drama, you might want to look at Costco Wholesale Corp. (COST), advises Nicholas Vardy, editor of The Global Guru.

Yes — Costco. The warehouse retailer that sells 48-packs of paper towels, rotisserie chickens at a loss, and $1.50 hot dogs that haven’t gone up in price since the 1980s.

Let’s get the obvious out of the way: Costco is expensive. By traditional metrics, it looks stretched. A 52.4x forward P/E implies investors are willing to pay a massive premium for what, on the surface, is a no-growth business.

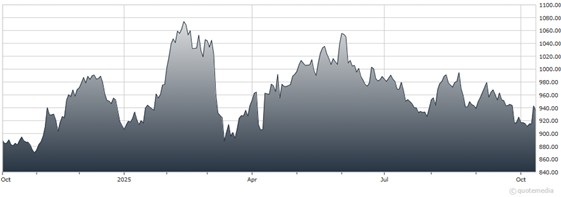

Costco Wholesale Corp. (COST)

But that would be a misread. Costco is not a no-growth story. In fact, it has outperformed the S&P 500 Index (^SPX) by 3.4x over the last decade. And it has done so without hype, without massive leverage, and without compromising on operational discipline.

At the heart of Costco’s economic engine is its membership model. Roughly 75% of operating profit comes not from selling products, but from the annual membership fees paid by its 129 million cardholders. These memberships renew at a 90%+ rate, year after year. That means before a single product is sold, Costco is already cash-flow positive. It’s a subscription business disguised as a warehouse.

Most supermarkets carry 30,000 to 100,000 products. Costco? Just 3,800. That constraint is deliberate — and powerful. Fewer SKUs mean faster inventory turnover, better negotiating power with suppliers, simpler logistics, less decision fatigue for customers, and higher sales per square foot.

Costco is not a moonshot stock. It won’t 5x in a year. But sometimes, the real alpha doesn’t come from betting on what’s next — but from owning the few businesses that quietly compound without blowing up. In that sense, Costco might not be the hottest stock in America — just the most loved.

Subscribe to The Global Guru here…