Clean energy and semiconductors just powered a breakout week. According to data from our partner Trackinsight, US ETFs recorded strong inflows last week totaling $40.2 billion, led by equity ETFs with $26.1 billion and fixed income ETFs with $9.7 billion, writes Tony Dong, lead ETF analyst at ETF Central.

Commodity ETFs added $5.4 billion, while cryptocurrency products saw outflows of $975 million. The Other category recorded redemptions of $30 million.

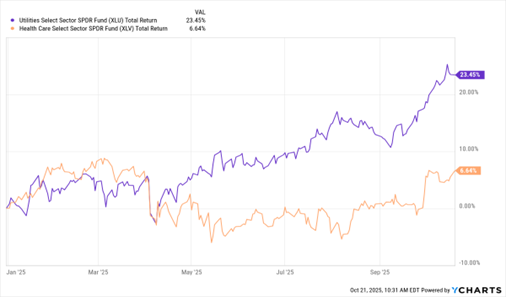

XLU, XLV (YTD % Change)

Data by YCharts

By sector, healthcare ETFs gained 1.2% with $800 million in inflows, followed by utilities (+1.6%, $669 million), information technology (+2.7%, $480 million), and materials (+3.2%, $344 million). Real estate rose 3.2% with $194 million in inflows. Industrials posted a 0.2% increase and attracted $47 million.

Regional flows were dominated by the US, which attracted $20.1 billion. Thematic ETFs recorded steady inflows, led by digital infrastructure and connectivity ($294 million), Artificial Intelligence (AI) and big data ($247 million), nuclear energy ($236 million), smart city ($223 million), and strategic metals ($189 million).

Commodity ETFs recorded total inflows of $5.4 billion, dominated by gold ($5.2 billion) and silver ($188 million). Multi-commodity ETFs saw redemptions of $148 million.

Meanwhile, performance leaders among thematic ETFs were hydrogen economy (+7.5%), branding and luxury (+6.7%), alternative energy (+5.1%), life sciences (+4.1%), and solar energy (+3.4%). Negative performances were seen in cryptocurrency (-7.9%), Asia defense (-5.9), China disruptive technology (-4.6%), global defense (-4.5%), and China digitalization (-4.1%).