The stock market rallied to all-time highs last week, with the S&P 500 Index (^SPX) closing at 6,791.69 on Friday. The index is up 15.5% year-to-date. Now, with AI technology sweeping across industries, let’s talk about what it means for the labor market in the coming years, writes Sam Ro, editor of Tker.co.

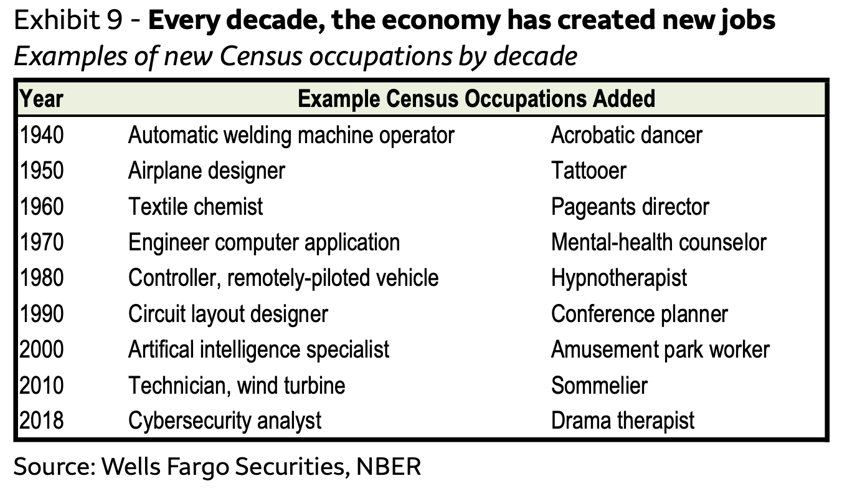

History shows that the world is pretty good at adapting to disruptive technology. We have repeatedly seen the same pattern: While many jobs may get destroyed in the technological transition, many new ones are also created. A study recently cited by Goldman Sachs found that 60% of workers are employed in jobs that weren’t recognized by the Census before 1940.

(Editor’s Note: Sam will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

Wells Fargo’s Ohsung Kwon compiled a brief list of some of these newer jobs.

Of course, this process of creative destruction doesn’t happen overnight. In the three years since the launch of ChatGPT and AI quickly becoming ubiquitous, the labor market hasn’t shifted all that much. As of August, employment was at a record high and layoff activity remained depressed.

But Goldman Sachs economists warn we may experience some “transitional friction.” And they caution that we may not see major job losses until the economy enters a full-blown recession.

What makes AI particularly concerning for the economy is that it threatens to replace workers, which could make this transition particularly challenging. We’re having this discussion as key labor turnover metrics, including job openings and the hiring rate, have fallen sharply over the past three years. This suggests the economy is at a tipping point, which means large-scale job losses could be next.

I’m personally cognizant of how AI threatens to disrupt industry. I work in media. I regularly hear about how AI is creating headaches for the news business, ranging from declines in search traffic to newsroom cuts to various ethical quandaries.

But while many companies may struggle or even fail during this transition, many will evolve and adapt, perhaps in surprising ways. This has always been the case.

Accordingly, as an investor with a broadly diversified portfolio of stocks, I remain optimistic in the long run. I’m bullish on the promise of AI, especially in the context of how productivity gains help earnings and stock prices head higher. Even if the disruption means my job as I know it is in peril.